That brings us to the last level: the level IV multiverse intimately tied up with your mathematical universe, the “crackpot idea” you were once warned against. Perhaps we should start there.

I begin with something more basic. You can call it the external reality hypothesis, which is the assumption that there is a reality out there that is independent of us. I think most physicists would agree with this idea.

The question then becomes, what is the nature of this external reality?

If a reality exists independently of us, it must be free from the language that we use to describe it. There should be no human baggage.

I see where you’re heading. Without these descriptors, we’re left with only math.

The physicist Eugene Wigner wrote a famous essay in the 1960s called “The Unreasonable Effectiveness of Mathematics in the Natural Sciences.” In that essay he asked why nature is so accurately described by mathematics. The question did not start with him. As far back as Pythagoras in the ancient Greek era, there was the idea that the universe was built on mathematics. In the 17th century Galileo eloquently wrote that nature is a “grand book” that is “written in the language of mathematics.” Then, of course, there was the great Greek philosopher Plato, who said the objects of mathematics really exist.

How does your mathematical universe hypothesis fit in?

Well, Galileo and Wigner and lots of other scientists would argue that abstract mathematics “describes” reality. Plato would say that mathematics exists somewhere out there as an ideal reality. I am working in between. I have this sort of crazy-sounding idea that the reason why mathematics is so effective at describing reality is that it is reality. That is the mathematical universe hypothesis: Mathematical things actually exist, and they are actually physical reality.

[...]

But why do some equations describe our universe so perfectly and others not so much?

Stephen Hawking once asked it this way: “What is it that breathes fire into the equations and makes a universe for them to describe?” If I am right and the cosmos is just mathematics, then no fire-breathing is required. A mathematical structure doesn’t describe a universe, it is a universe. The existence of the level IV multiverse also answers another question that has bothered people for a long time. John Wheeler put it this way: Even if we found equations that describe our universe perfectly, then why these particular equations and not others? The answer is that the other equations govern other, parallel universes, and that our universe has these particular equations because they are just statistically likely, given the distribution of mathematical structures that can support observers like us.

Showing posts with label J.K.. Show all posts

Showing posts with label J.K.. Show all posts

Wednesday, December 23, 2009

Math without end, amen

In the comments of a previous post, Commenter J.K. linked to this Discover interview with cosmologist Max Tegmark, "Is the Universe Actually Made of Math?". Worth reading in full, if you are interested in this sort of thing, but here are a few excerpts from the interview that start in media res.

Wednesday, October 14, 2009

Update on Q&A with Alloy Steel International

I mentioned this in the comment thread of a previous post, but for those who missed it,

The list of questions ended up being fairly long. Gene [Kostecki, AYSI's CEO] wrote back to say that he and Alan [Winduss, the company's CFO] planned to try to answer all the questions by midweek next week. In light of that time frame, I am going to revise my previous comment about not placing any trades until I post their response. I am going to place additional limit buy orders today but I won't modify them if they don't fill until after I have posted AYSI's responses to the questions. The salient point remains that I won't be buying or selling AYSI based on answers received from the company before posting them here.

I put in a GTC limit order in the low 2's this morning, but obviously didn't get it filled today, given today's price action. Speaking of which: commenter J.K. (who, as far as I know, is the only reader to have invested in AYSI after reading about it here), sold his shares at around $2.70 recently, because he felt that the chart suggested the stock would pull back below $2 in the near future. I've held (and added a tiny bit more) because I don't think the stock will drop below $2 before earnings are released absent materially negative news, and I don't want to risk having the stock run away from me if additional positive news is released (e.g., a big supply deal with another multinational mining company).

Essentially, J.K. feels the stock's near-term trajectory will be driven by technical factors and I think it will continue to be driven by fundamentals. It will be interesting to see which one of us turns out to be correct over the next couple of months.

Wednesday, September 9, 2009

Nature Versus Nurture

Hat tip to J.K. for these two items.

First, this article on Barry James Sanders, 14 year old star high school running back and son of NFL Hall of Fame running back Barry Sanders. Excerpt:

Here's a clip of Barry James Sanders breaking one the way his Dad used to:

Next we have this article on Moshe Kai Cavalin, an 11 year old who just graduated college with a degree in astrophysics. Are his smarts inherited, as the author of the previous article writes Barry James Sanders's running back skills are? Young Moshe (pictured below) demurs:

As J.K. facetiously noted in the comment thread of a previous post, both boys clearly have a lot of grit.

First, this article on Barry James Sanders, 14 year old star high school running back and son of NFL Hall of Fame running back Barry Sanders. Excerpt:

"There are a lot of similarities especially in the way they cut," [BJS's High School Football Coach Andy] Bogert said. "Some of the plays - you could probably superimpose them running together, and they'd look really similar."

Those similarities are inherited rather than learned.

Barry Sanders says he has focused on being a father instead of a coach to his son. He views Sanders hanging out with good peers and continuing to avoid negative influences as a far more important goal.

"I can't think of anything I've given him advice on as far as (playing) ball," Sanders said.

"There's going to be a lot of advice he's going to need, and probably the thing that he'll need the least help with will be football.

Here's a clip of Barry James Sanders breaking one the way his Dad used to:

Next we have this article on Moshe Kai Cavalin, an 11 year old who just graduated college with a degree in astrophysics. Are his smarts inherited, as the author of the previous article writes Barry James Sanders's running back skills are? Young Moshe (pictured below) demurs:

"I don't consider myself a genius because there are 6.5 billion people in this world and each one is smart in his or her own way," Cavalin told Wood TV.

[...]

Cavalin's parents avoid calling their son a genius. They say he's just an average kid who enjoys studying as much as he likes playing soccer, watching Jackie Chan movies, and collecting toy cars and baseball caps with tiger emblems on them. He was born during the Year of the Tiger in the Chinese zodiac.

Cavalin has a general idea what his IQ is, but doesn't like to discuss it. He says other students can achieve his success if they study hard and stay focused on their work.

As J.K. facetiously noted in the comment thread of a previous post, both boys clearly have a lot of grit.

Thursday, May 21, 2009

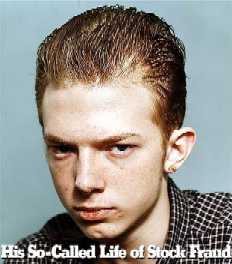

A Stock-Promoting Prodigy

Hat tip to reader J.K. for this news item about civil and criminal charges brought against the alleged perpetrators of a cross-country pump & dump stock racket. One of the accused is Matthew Brown, who operates a stock message board site we've mentioned here before, Investor Hub.

J.K.'s mention of that news reminded me of an excellent New York Times Magazine article from 2001, written by Michael Lewis, about high school student who made a small fortune promoting stocks during the dot-com boom: "Jonathan Lebed's Extracurricular Activities". Jonathan Lebed made close to a million dollars buying stocks, pumping them on Internet message boards, and then selling after driving up their prices. This eventually drew the wrath of the SEC. One of the best parts of Michael Lewis's article is when he tries to pin the SEC down on what, exactly, made Lebed's stock promotion different from that of Wall Street's. This scene, which we'll enter in medias res, starts on page 8 of Lewis's article:

''Richard -- call Richard!'' [then-SEC Chairman Arthur] Levitt was shouting out the door of his vast office. ''Tell Richard to come in here!''

Richard was Richard Walker, the S.E.C.'s director of enforcement. He entered with a smile, but mislaid it before he even sat down. His mind went from a standing start to deeply distressed inside of 10 seconds. ''This kid was making predictions about the prices of stocks,'' he said testily. ''He had no basis for making these predictions.'' Before I could tell him that sounds a lot like what happens every day on Wall Street, he said, ''And don't tell me that's standard practice on Wall Street,'' so I didn't. But it is. It is still O.K. for the analysts to lowball their estimates of corporate earnings and plug the stocks of the companies they take public so that they remain in the good graces of those companies. The S.E.C. would protest that the analysts don't actually own the stocks they plug, but that is a distinction without a difference: they profit mightily and directly from its rise.

''Jonathan Lebed was seeking to manipulate the market,'' said Walker.

But that only begs the question. If Wall Street analysts and fund managers and corporate C.E.O.'s who appear on CNBC and CNNfn to plug stocks are not guilty of seeking to manipulate the market, what on earth does it mean to manipulate the market?

[...]

I finally came clean with a thought: the S.E.C. let Jonathan Lebed walk away with 500 grand in his pocket because it feared that if it didn't, it would wind up in court and it would lose.

[...]

I might as well have strolled into the office of the drug czar and lit up a joint.

''The kid himself said he set out to manipulate the market,'' Walker virtually shrieked. But, of course, that is not all the kid said. The kid said everybody in the market was out to manipulate the market.

''Then why did you let him keep 500 grand of his profits?'' I asked.

''We determined that those profits were different from the profits he made on the 11 trades we defined as illegal,'' he said.

Lewis goes on to underline the tautologies.

J.K. noted that Jonathan Lebed is still in the stock promotion business. Here is his site.

The photo above, of Jonathan Lebed, is the cover of the New York Times Magazine issue in which Lewis's article on Lebed was published. For some reason, the New York Times doesn't include the photos that accompanied its older articles in its online archive, so I got that image from Williamgaddis.org. For those too old or young to catch the allusion, the photo's caption is a play on the title of a short-lived cult TV drama from the mid-1990s called My So-Called Life.

Wednesday, April 15, 2009

A Conversation with the CFO of Destiny Media

Fred Vandenberg, the CFO of Destiny Media Technologies (OTC BB: DSNY.OB) returned my call today. Below are some notes from our conversation.

- Vandenberg is confident that the company's revenues will be 30% greater sequentially in its Q3 and that the company will be profitable in Q3. He said the 30% increase estimate was "conservative". Although the company's CEO, Steve Vestergaard, has incorrectly predicted profitability more than once in the past, this is the first time in my conversations with him that the CFO, Fred Vandenberg, has predicted profitability.

- Vandenberg expected expenses to remain inline next quarter.

- He believes Q4 and Q1 2010 will show continued sequential growth in revenues.

- He agrees with Vestergaard's point about seasonality in Play MPE revenues, noting that Destiny's fiscal Q1 (which straddles the calendar year-end) tends to be the busiest for Play MPE revenues, and its Q2 tends to be the weakest, with Q3 and Q4 closer to Q1 in revenue levels. Says seasonality may have been obscured in previous years by minimum charges.

- Deferred to Vestergaard on discussions of Clipstream, but essentially said that, as a small company, they've been focusing more on Play MPE, because that's where they can get imminent profitability.

- I asked about the note in the 10-Q about that the company will need to raise additional funds. Vandenberg suggested that this was there to satisfy the auditors and said that, since the company would be profitable next quarter, it wouldn't need external financing to keep the lights on, but might consider such financing down the road to pay for an expansion, if the money were available at a reasonable price.

- Said that the potential revenue for digital distribution for the company in North America was about $20 million, though Destiny may not approach that target as fast as they had hoped. Wouldn't get too specific here, but it seems that there may be a need to increase adoption within organizations that have signed agreements with Destiny1. Said potential revenue from digital distribution globally ex-North America was another $40 million, and revenue may grow faster internationally2.

- Clarified the issue of sends somewhat. Said Destiny has a sliding scale for sends greater than one song, e.g. "small bundles", "albums", and "boxed sets". I asked which of these 'packages' the average send consisted of and what the charge for that 'package' was. He said he'd try to get back to me with that info; I'll post it on this blog if he does. If, for example, the average 'package' was a small bundle, and Destiny charged $x per small bundle, we'd be better able to estimate Play MPE revenue from the send stats.

In the comment thread of the previous post on Destiny Media ("Destiny Media Technologies: Still Losing Money"), reader J.K. made a good argument for selling the stock:

Closed my position in DSNY today and bought CRY.

I love the DSNY concept.

But I'm not going to hold on to an overpromising, underperforming, money losing penny stock right now. If they become profitable in the near future I may re-enter. Somehow I doubt I'll miss any big move by doing this, should I want to buy back in, but who knows. Also, if the dollar collapses against the loonie due to high commodity prices and Fed dilution, as I anticipate, then it will be even harder for them to become profitable soon.

Based on my conversation with Vandenberg today though, I am inclined to hold DSNY for another quarter.

1I've had some experience with this sort of situation. Several years ago, when I worked as a business development director for a financial internet start-up, I signed firm-wide deals with a number of financial services firms to use my company's service. The first one of these deals I landed was with a firm where the home office had a lot of influence in what was done by its regional employees, and so there was fairly broad adoption. The second of these deals I closed was with a smaller firm in the San Francisco Bay area, where I had known one of the principals from a previous job. Months after closing that deal, not one of this company's hundred plus brokers had used our system. It didn't matter that the benefits of the system were apparent to me and to the firm's principals: the firm's brokers had different ideas. As important, perhaps, this smaller firm didn't have any staff assigned to promote our system internally. In contrast, the first company I signed up did have such a staff and made good use of it. The lesson here is that it's not enough to have a better mousetrap, and it's not even enough, necessarily, for senior executives of a client firm to agree that you have a better mousetrap: the firm's end-users need to be convinced too.

2By way of explanation, Vandenberg mentioned that the adoption of Play MPE is more top-down in some markets. In Sweden, for example, he said that the labels tended to set the standard and the radio stations fell in line.

Saturday, February 14, 2009

FT Letter Writer Seconds Commenter J.K.

In the comment thread of a recent post ("Singularity U."), commenter J.K. took the editors of the Financial Times to task for their dismissive editorial about Ray Kurzweil’s "Singularity" concept. In today's FT, letter writer David Crooks offers similar sentiments:

From Mr David Crookes.Sir, You say: “And even if researchers do endow machines with real intelligence ... why should it suddenly grow exponentially ... ?” (“Singular fantasies”, editorial, February 7).

You’ve not been paying attention in class, since this is Ray Kurzweil’s key point (and that of others, for example Vernor Vinge).

The substrate of future machine intelligence is expected to be computation, which is increasing in power exponentially thanks to Moore’s Law. The year we get a silicon FT editor for the price of a laptop, the next year we get two for the price of one. How long before the entire FT staff can be replaced by one laptop?

David Crookes,

Inverness, UK

Tuesday, January 20, 2009

"Dark City"

In the comment thread of a previous post about Darren Aranofsky's film "The Fountain" ("Nigel Andrews on Darren Aranofsky"), we referred to another ambitious film with sci-fi elements that got mixed reviews, but was considered a masterpiece by at least one reviewer, Alex Proyas's 1998 film "Dark City". Below is the first paragraph of Roger Ebert's review of it (commenter Sivaram should be forewarned that Ebert mentions "2001: A Space Odyssey" in comparison):

As I noted to commenter J.K. in the Aranofsky comment thread, there were a few differences between the director's cut DVD of "Dark City" and the theatrical version. One of them was that, in the director's cut, Jennifer Connelly actually sang, instead of lip-syncing as she did in the theatrical version. The clip below, from the director's cut, features her singing "Sway".

``Dark City'' by Alex Proyas is a great visionary achievement, a film so original and exciting, it stirred my imagination like ``Metropolis'' and ``2001: A Space Odyssey.'' If it is true, as the German director Werner Herzog believes, that we live in an age starved of new images, then ``Dark City'' is a film to nourish us. Not a story so much as an experience, it is a triumph of art direction, set design, cinematography, special effects--and imagination.

As I noted to commenter J.K. in the Aranofsky comment thread, there were a few differences between the director's cut DVD of "Dark City" and the theatrical version. One of them was that, in the director's cut, Jennifer Connelly actually sang, instead of lip-syncing as she did in the theatrical version. The clip below, from the director's cut, features her singing "Sway".

Saturday, August 16, 2008

James Altucher's Chinese Stock Picks

On his Stockpickr website, James Altucher writes about "Five Chinese Stocks Poised to Double". Altucher is a serial entrepreneur who writes an entertaining column in the Financial Times in addition to his work on StockPickr, and, like his friend Jim Cramer, has no shortage of stock ideas. I tend to put weight in someone's stock recommendations in an inverse proportion to the number of recommendations that person makes. That said, with the Chinese stock market down so much, there may be some bargains there, so Altucher's picks may be worth a look. Perhaps reader and China hand J.K. will offer his opinion on these. J.K. has had some successful investments in Chinese stocks and is also knowledgeable about some their unique risks. Here are the five companies Altucher recommends (Altucher's column includes descriptions of each of their businesses):

Giant Interactive (GA)

China Precision Steel (CPSL)

Cogo Group (COGO)

China BAK Battery (CBAK)

Shengdatech (SDTH)

Giant Interactive (GA)

China Precision Steel (CPSL)

Cogo Group (COGO)

China BAK Battery (CBAK)

Shengdatech (SDTH)

Subscribe to:

Posts (Atom)