Saturday, May 30, 2009

Better Late than Never

Are Inflation Fears Overdone?

In an editorial yesterday ("US not in bondage") the FT editors wrote,

Shock, horror: US government bond rates are jumping. Soon, goes the story, long-term interest rates will leap, the Federal Reserve will monetise, inflation will soar and civilisation will end. Actually, no. What is happening is precisely the normalisation the Fed has sought. The government is not off the fiscal hook. But it does have at least some time.

[...]

What has happened, quite simply, is normalisation of inflation expectations

[...]

Does this mean nobody needs to worry? Certainly not. Desirable normalisation could yet become a panic over the massive prospective bond issuance. Now that the worst of the panic has passed, the administration and Congress need to agree a credible plan for elimination of the huge structural fiscal deficits. As the Congressional Budget Office’s forecasts demonstrate, President Barack Obama’s budget proposal is not such a plan: it leaves deficits of between 4 and 6 per cent of gross domestic product as far as the eye can see. This will need to change soon. But, right now, everybody needs to keep calm. Normalisation is a big success, not a danger.

In his New York Times column yesterday ("The Big Inflation Scare"), Dr. Krugman made a similar point: Inflation isn't a near-term concern, but we do

[H]ave a long-run budget problem, and we need to start laying the groundwork for a long-run solution.

Krugman also brought up the example of Japan, which has borrowed massively in recent years without driving up its interest rates or inflation. What many Americans fear -- our country losing its triple-A credit rating and having its government debt exceed 100% of its GDP -- has already happened in Japan (The CIA World Factbook says Japan's public debt exceeds 170% of its GDP). And yet, Japan's borrowing costs are significantly lower than ours. For example, according to Bloomberg, the current yield on 10-year U.S. Treasuries is 3.46%, versus 1.49% on the 10-year Japanese government bond.

I've wondered for some time about why Japan has so much lower borrowing costs than the U.S., despite having a lower sovereign debt rating and a much higher ratio of debt to GDP, but I haven't heard a convincing explanation yet. When I asked The Atlantic's Megan McCardle about this, she said the answer was Japan's Postal Savings System, but according to Wikipedia, prior to the beginning of its privatization in 2007, that system only held about 20% of Japan's government debt. Perhaps someone will leave a more convincing answer in the comment thread below.

Thursday, May 28, 2009

The Credit Crisis and Courtney Love

Bright Lights, Peak Oil

Hat tip to Aaron Edelheit (with a second assist to Paul Kedrosky) for this article by Chris Turner in the Walrus magazine (which looks like a Canadian version of the Atlantic magazine before the Atlantic's recent, garish redesign): "An Inconvenient Talk: Dave Hughes's guide to the end of the fossil fuel age".

From this article, Dave Hughes, a geologist/doomsayer, appears to be Canada's answer to Matt Simmons. For some reason (perhaps in tribute to the upcoming 25th anniversary of Jay McInerney's novel Bright Lights, Big City) Chris Turner refers to himself in this article in the second person. Here's a taste:

Dave had to start out fifteen minutes earlier than the requisite ungodly hour so he could pick you up at your house. So you wouldn’t drive yourself. Save a few hydrocarbons, he’d joked. He’s a coal man, a geologist, and he always refers to the holy trinity of fossil fuels whose flames have stoked the past 200 years of industrial growth — coal, natural gas, and especially oil — in that same semi-technical way: hydrocarbons. Dave Hughes has a lot to say about hydrocarbons, mainly how there’s no possible way to keep running the engine of a modern global economy for much longer at the pace we’re burning them. Which is why you felt compelled to join him in the black chill of this late-autumn morning. Because that seems like a pretty big deal.

The uninspired photo above of Dave Hughes (that's the best backdrop they could come up with in Calgary and its environs?) accompanies the article and is credited to "Wilkosz + Way".

Wednesday, May 27, 2009

Tuesday, May 26, 2009

Built to Last

My first exposure to the business guru Jim Collins came during a conference call in the late 1990s. I was sitting in a conference room in Northern New Jersey with several colleagues while our division head was on the speaker phone from his office in Southern California. The division head had announced two challenging new goals for us and one of my colleagues had apparently asked him which one should demand more of our attention. I wasn't listening too closely at that point. The division head's response caught my attention though, when I thought I heard him extol the "genius of the ant". "The genius of the ant," I thought, "what the hell is he talking about?". After another sentence or two it was clear that he was referring to one of the "myths" Jim Collins (pictured above, rock climbing) debunked on p.10 of his book, Built to Last: Successful Habits of Visionary Companies:

Visionary companies do not brutalize themselves with the "Tyranny of the Or" -- the purely rational view that says you can have either A or B, but not both.

[...]

Instead, they embrace the "Genius of the And" -- the paradoxical view that allows them to pursue both A and B at the same time.

At the time, I thought: another management guru serves his purpose, by letting a manager parrot him to rationalize why he set an unrealistic goal. I was scheduled to be interviewed by that division head for a promotion in a couple of weeks, so I decided to read the book before the interview. The book was better and more substantive than I had expected. In it, Collins compared companies he considered great with companies in the same industries he considered also-rans, and tried to explain what made the great ones great. One of the invidious comparisons in the book, Merck (great) v. Pfizer (also-ran) seemed questionable by the late 1990s, when Pfizer was raking in money from Viagra, but I was reminded of it a couple of weeks ago when Pfizer announced that it would start giving away Viagra, Lipitor, and a number of other drugs to current patients who lost their jobs during this recession.

In "Built to Last", Collins had written that one of the things that made Merck great was the company's idealism, and as an example he cited the company's decision to give away Mectizan, the cure it had developed for River Blindness, when it couldn't find a third party to pay for the drug. Collins also quoted then-Merck CEO Roy Vagelos on the decision:

Asked why Merck made the Mectizan decision, Vagelos pointed out that the failure to go forward with the project would have demoralized Merck scientists -- scientists working for a company that viewed itself as "in the business of preserving and improving human life." He also commented:When I first went to Japan fifteen years ago, I was told by Japanese business people that it was Merck that brought streptomycin to Japan after World War II, to eliminate tuberculosis which was eating up their society. We did that. We didn't make any money. But it's no accident that Merck is the largest American pharmaceutical company in Japan today. The long-term consequences of [such actions] are not always clear, but somehow I think they always pay off.

Perhaps Pfizer CEO Jeffrey Kindler has read "Built to Last"? That thought went through my mind when I heard the Pfizer announcement a couple of weeks ago, but I didn't get around to blogging about it. I was reminded of it by the cover article on Jim Collins in this past Sunday's New York Times business section, "For this Guru, No Question is Too Big". The photo above, by Kevin Moloney, accompanied that article.

Monday, May 25, 2009

Remembering Roy Benavidez on Memorial Day

During downtime years ago, I read through a book of Medal of Honor citations. One of the most impressive ones was for Master Sergeant Roy Benavidez (pictured above), for his actions "west of Loc Ninh, Vietnam" [i.e., in Cambodia] on May 2nd, 1968. At the time, then-Staff Sergeant Benavidez was awarded the Distinguished Service Cross, reportedly because his commanding officer didn't think he'd survive long enough be be awarded a non-posthumous Medal of Honor, given the severity of Benavidez's wounds. MSG Benavidez was eventually awarded the Medal of Honor by President Reagan. Below is MSG Benavidez's Medal of Honor citation, via Valor Remembered.

On the morning of 2 May 1968, a 12 man Special Forces Reconnaissance Team was inserted by helicopters in a dense jungle area west of Loc Ninh, Vietnam to gather intelligence information about confirmed large-scale enemy activity. This area was controlled and routinely patrolled by the North Vietnamese Army. After a short period of time on the ground, the team met heavy enemy resistance, and requested emergency extraction. Three helicopters attempted extraction, but were unable to land due to intense enemy small arms and anti-aircraft fire.

Sergeant Benavidez was at the Forward Operating Base in Loc Ninh monitoring the operation by radio when these helicopters returned to off-load wounded crewmembers and to assess aircraft damage. Sergeant Benavidez voluntarily boarded a returning aircraft to assist in another extraction attempt. Realizing that all the team members were either dead or wounded and unable to move to the pickup zone, he directed the aircraft to a nearby clearing where he jumped from the hovering helicopter, and ran approximately 75 meters under withering small arms fire to the crippled team.

Prior to reaching the team's position he was wounded in his right leg, face, and head. Despite these painful injuries, he took charge, repositioning the team members and directing their fire to facilitate the landing of an extraction aircraft, and the loading of wounded and dead team members. He then threw smoke canisters to direct the aircraft to the team's position. Despite his severe wounds and under intense enemy fire, he carried and dragged half of the wounded team members to the awaiting aircraft. He then provided protective fire by running alongside the aircraft as it moved to pick up the remaining team members.

As the enemy's fire intensified, he hurried to recover the body and classified documents on the dead team leader. When he reached the leader's body, Sergeant Benavidez was severely wounded by small arms fire in the abdomen and grenade fragments in his back. At nearly the same moment, the aircraft pilot was mortally wounded, and his helicopter crashed.

Although in extremely critical condition due to his multiple wounds, Sergeant Benavidez secured the classified documents and made his way back to the wreckage, where he aided the wounded out of the overturned aircraft, and gathered the stunned survivors into a defensive perimeter. Under increasing enemy automatic weapons and grenade fire, he moved around the perimeter distributing water and ammunition to his weary men, re-instilling in them a will to live and fight.

Facing a buildup of enemy opposition with a beleaguered team, Sergeant Benavidez mustered his strength, began calling in tactical air strikes and directed the fire from supporting gun ships to suppress the enemy's fire and so permit another extraction attempt. He was wounded again in his thigh by small arms fire while administering first aid to a wounded team member just before another extraction helicopter was able to land. His indomitable spirit kept him going as he began to ferry his comrades to the craft.

On his second trip with the wounded, he was clubbed from behind by an enemy soldier. In the ensuing hand-to-hand combat, he sustained additional wounds to his head and arms before killing his adversary [with a Bowie knife]. He then continued under devastating fire to carry the wounded to the helicopter. Upon reaching the aircraft, he spotted and killed two enemy soldiers who were rushing the craft from an angle that prevented the aircraft door gunner from firing upon them. With little strength remaining, he made one last trip to the perimeter to ensure that all classified material had been collected or destroyed, and to bring in the remaining wounded. Only then, in extremely serious condition from numerous wounds and loss of blood, did he allow himself to be pulled into the extraction aircraft.

Sergeant Benavidez's gallant choice to join voluntarily his comrades who were in critical straits, to expose himself constantly to withering enemy fire, and his refusal to be stopped despite numerous severe wounds, saved the lives of at least eight men. His fearless personal leadership, tenacious devotion to duty, and extremely valorous actions in the face of overwhelming odds were in keeping with the highest traditions of the military service, and reflect the utmost credit on him and the United States Army.

The photo above, of MSG Benavidez wearing his Medal of Honor, comes from Valor Remembered.

Saturday, May 23, 2009

A Note about the Light Posting Here Recently

As always, feel free to suggest topics for future posts. If I'm interested in the topic, and I think I might have something useful to add to the discussion, I'll post on it as time permits.

Thursday, May 21, 2009

A Stock-Promoting Prodigy

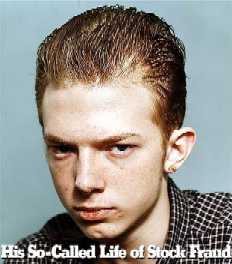

Hat tip to reader J.K. for this news item about civil and criminal charges brought against the alleged perpetrators of a cross-country pump & dump stock racket. One of the accused is Matthew Brown, who operates a stock message board site we've mentioned here before, Investor Hub.

J.K.'s mention of that news reminded me of an excellent New York Times Magazine article from 2001, written by Michael Lewis, about high school student who made a small fortune promoting stocks during the dot-com boom: "Jonathan Lebed's Extracurricular Activities". Jonathan Lebed made close to a million dollars buying stocks, pumping them on Internet message boards, and then selling after driving up their prices. This eventually drew the wrath of the SEC. One of the best parts of Michael Lewis's article is when he tries to pin the SEC down on what, exactly, made Lebed's stock promotion different from that of Wall Street's. This scene, which we'll enter in medias res, starts on page 8 of Lewis's article:

''Richard -- call Richard!'' [then-SEC Chairman Arthur] Levitt was shouting out the door of his vast office. ''Tell Richard to come in here!''

Richard was Richard Walker, the S.E.C.'s director of enforcement. He entered with a smile, but mislaid it before he even sat down. His mind went from a standing start to deeply distressed inside of 10 seconds. ''This kid was making predictions about the prices of stocks,'' he said testily. ''He had no basis for making these predictions.'' Before I could tell him that sounds a lot like what happens every day on Wall Street, he said, ''And don't tell me that's standard practice on Wall Street,'' so I didn't. But it is. It is still O.K. for the analysts to lowball their estimates of corporate earnings and plug the stocks of the companies they take public so that they remain in the good graces of those companies. The S.E.C. would protest that the analysts don't actually own the stocks they plug, but that is a distinction without a difference: they profit mightily and directly from its rise.

''Jonathan Lebed was seeking to manipulate the market,'' said Walker.

But that only begs the question. If Wall Street analysts and fund managers and corporate C.E.O.'s who appear on CNBC and CNNfn to plug stocks are not guilty of seeking to manipulate the market, what on earth does it mean to manipulate the market?

[...]

I finally came clean with a thought: the S.E.C. let Jonathan Lebed walk away with 500 grand in his pocket because it feared that if it didn't, it would wind up in court and it would lose.

[...]

I might as well have strolled into the office of the drug czar and lit up a joint.

''The kid himself said he set out to manipulate the market,'' Walker virtually shrieked. But, of course, that is not all the kid said. The kid said everybody in the market was out to manipulate the market.

''Then why did you let him keep 500 grand of his profits?'' I asked.

''We determined that those profits were different from the profits he made on the 11 trades we defined as illegal,'' he said.

Lewis goes on to underline the tautologies.

J.K. noted that Jonathan Lebed is still in the stock promotion business. Here is his site.

The photo above, of Jonathan Lebed, is the cover of the New York Times Magazine issue in which Lewis's article on Lebed was published. For some reason, the New York Times doesn't include the photos that accompanied its older articles in its online archive, so I got that image from Williamgaddis.org. For those too old or young to catch the allusion, the photo's caption is a play on the title of a short-lived cult TV drama from the mid-1990s called My So-Called Life.

Tuesday, May 19, 2009

A Sucker for a Pretty Business Journalist

Hat tip to Sivaram for alerting me to Michael Lewis's review of Alice Schroeder's Buffett biography in the New Republic1, "Master of Money". Lewis notes in the beginning of his review that,

Buffett has a long and happy history of admitting attractive, intelligent women into his life, which Schroeder describes without mentioning how neatly she fits into the pattern.

How she fits in the pattern, apparently, is that unlike other female business journalists -- e.g., CNBC's Becky Quick, and Liz Claman (now at Fox Business) who preceded her as the network's Buffett correspondent, Schroeder was intent on using her access to paint a warts-and-all portrait of Buffett as a person as well as as an investor. That leads to some interesting material, which is surveyed in Lewis's review. It's an entertaining read, as Lewis's essays usually are.

The photo above, of Warren Buffett and Alice Schroeder, comes from Khotanharmon.com.

1Now that Condé Nast has pulled the plug on Portfolio, perhaps TNR will be a regular home for Michael Lewis's essays.

Sunday, May 17, 2009

Algebra Challenge

Weight Watchers uses a formula that takes into account total calories, grams of fat, and grams of fiber to assign point values to foods. According to the Weight Watchers formula, a McDonald's hamburger is worth 5 points, a McDonald's cheeseburger is worth 7 points, and a McDonald's double cheeseburger is worth 10 points. According to McDonald's, the hamburger has 250 calories, 9 grams of fat and 2 grams of fiber; the cheeseburger has 300 calories, 12 grams of fat, and 2 grams of fiber; and the double cheeseburger has 440 calories, 23 grams of fat, and 2 grams of fiber.

What is the Weight Watchers formula?

The photo above, of the McDonald's double cheeseburger, comes from bloggingstocks.com.

Saturday, May 16, 2009

John Mauldin's Latest

On America's Fiscal Challenges:

The following headline caught my eye: "Obama Says US Long-Term Debt Load is 'Unsustainable.'" Yet they announced a $1.8 trillion deficit, which is really going to be at least $2 trillion, and are getting ready to pass health-care programs that will mean at least a trillion in deficits for as long as one can project.

How will they pay for it? Even getting rid of the Bush tax cuts will only produce a few hundred billion a year, which is nowhere near enough. They project much lower medical costs in the future, because they assume they are going to figure out ways to cut costs and make medical care more efficient1. As if no one has ever tried that.

[...]

You cannot propose massive increases in spending without either creating crushing debt that the markets will simply not allow, pushing interest rates much higher and really slowing growth and hurting the economy. It is a simple fact that you cannot increase the debt-to-GDP ratio without limit.

We found the limit on personal and corporate debt this past year. We pushed the limits until the system crashed. And now the US government wants to basically do the same thing. They are planning to see where the limits on government debt-to-GDP will be. Unless cooler and more rational heads in the Democratic Party prevail, this is not going to be pretty. Sometime in the middle of the next decade we will hit the wall, and it will make the current crisis pale in comparison.

The only way to solve the problem is to grow GDP more rapidly than debt, and for that to happen you have to have policies which are shaped for the growth of the economy or massive savings by consumers. And right now we have neither. Cap and trade is hugely anti-growth. So are high corporate taxes, and Obama is proposing to effectively raise corporate taxes by closing loopholes for income earned outside the US. Much better would be to lower the overall corporate level to a competitive world rate and then require the offshore income to be taxed.

Some Potential Good News about Health Care:

This week I visited the Cleveland Clinic and went through their Executive Health Program (more on that below). I got to visit for several hours with my doctor, Michael Roizen, of YOU: The Owner's Manual fame (not to mention all his subsequent books). They have now sold over 20 million copies, and I highly recommend them.

I have long been a student of medical trends, and long-time readers know that I think the next really big boom will be in the biotech world. I asked Mike what three things he thought would have the biggest impact in the next five years in medicine. What he said gave me hope, because he thinks there may be some advances in medicine that could help solve some of the basic health issues we all face, and at the same time give us some relief from the high and rising costs of medical care. I was aware of most of the research, but did not know that we were as close as it appears we actually are.

Briefly, he feels there are three developments in late-stage trials that could have major impacts. The first is the development of sirtuin, which so far seems to be delaying the effects of diabetes but also seems to work for a host of diseases that are inflammatory in nature (including many heart-related issues). It essentially delays the symptoms for 30-40 years. While the current trials are for very specific diseases, he thinks sirtuin will have a wide applicability and that it could be huge, as inflammation is the cause of a number of diseases. This could prolong useful life and forestall a number of debilitating conditions.

Second, there is a late-stage-three trial due out soon that promises to increase muscle mass. I have been reading about such developments, but was not aware that something might be available within a few years. This promises to help people stay active a lot longer than currently possible, which will be a good thing if we are going to live longer.

And finally, there is a study and trial which shows that DHA may delay the onset of Alzheimer's disease, which eats up a significant portion of US medical budgets.

It would be a sad irony if pending universal health care legislation leads to price controls which dry up the funding for these potentially cost-saving advances.

1Megan McArdle had a good post on this on her Atlantic blog earlier this week, "Medicare is going to bankrupt us, which is why we need universal health care". Excerpt:

Perhaps predictibly, someone showed up in the comments to my post on Medicare and Social Security to argue that liberal analysts have very serious plans to cut Medicare's costs, which is why we need universal coverage, so that we can implement those very serious plans.

I hear this argument quite often, and it's gibberish in a prom dress. Any cost savings you want to wring out of Medicare can be wrung out of Medicare right now: the program is large and powerful enough, and costly enough, that they are worth doing without adding a single new person to the mix. Conversely, if there is some political or institutional barrier which is preventing you from controlling Medicare cost inflation, than that barrier probably is not going away merely because the program covers more people.

John Mauldin, Best-Selling author and recognized financial

expert, is also editor of the free Thoughts From the Frontline

that goes to over 1 million readers each week. For more

information on John or his FREE weekly economic letter

go to: http://www.frontlinethoughts.com/learnmore

Open Thread

Thursday, May 14, 2009

Edelheit versus Cramer

Jim Cramer is a liar, a whore of financial community, and a person who really pretends to tell it like it is, but actually misleads people as much as he can.

An excerpt of my response:

[Y]ou have a much smaller audience on the VIC, but haven’t you inaccurately hyped a stock or two there, promising that it’s earnings are about to “explode”? And remember, Cramer was preaching caution back when the Dow was around 11,000, telling investors to sell any stocks they couldn’t let ride for 5 years — and you attacked him for it at the time.

Perhaps a little more introspection is in order.

More at Aaron's blog.

Edelheit Agonistes

From the comment thread last month on his pick Hemisphere GPS (TSX: HEM.TO) on the Value Investors Club:

issambres839 (Aaron Edelheit):

How does a company that has no debt go from having a $250 million market cap to a $15 million market cap excluding net working capital?

While clearly $5 per share last May was too high in hindsight, is US$0.75 a little ridiculous?

Judging from the price action since then, apparently $0.75 was a "little ridiculous", but this one of the responses Edelheit got last month to his question:

oogum858:

Hi Issambres. . .I don't know anything about this company, but to your question of:

"How does a company that has no debt go from having a $250 million market cap to a $15 million market cap excluding net working capital?"

Obviously one potential answer is "Because the company is worth $15mm"

Given the desperate nature of your question I wanted to at least write down the most obvious response. I do this not to be a jerk, but because you seem to be insanely frustrated and at the very least it's good to try to think clearly about such things. Mr. Market revalues companies all the time and it can be really exasperating when you think he/it/whatever is totally wrong. But you have to make allowances for the divergent opinion. I'm sure you're thinking about this question all the time, so sorry if this seems condescending. . but i dunno... how else could an uninformed VIC member answer your question?

Some other interesting comments there, and some thoughtful responses from Edelheit. Worth reading.

Wednesday, May 13, 2009

English Needs Another Word

On his Atlantic blog ("The End of the Torture Debate"), Ta-Nehisi Coates appears to consider the phrase "enhanced interrogation" a euphemism for torture. In this, he isn't alone, but I'd argue that, in the absence of a word that differentiates between things such as stress positions and thumb screws, "enhanced interrogation" is a legitimate phrase. When opponents of enhanced interrogation call anything other than asking a detainee politely for information "torture", they weaken their case.

You can argue that stress positions and other forms of enhanced interrogation (e.g., sleep deprivation, etc.) shouldn't be used on detainees at all. Or you can argue that their use ought to be carefully limited. But what's the point of calling it "torture"? I was doing stress positions last night, during my Club KO class: the plank position (pictured above), wall squats, holding the up position of a push-up (what we used to call in the Army the "front-leaning rest" position), etc. It was no picnic, but I can't call myself a victim of "torture" today. We need a better word for this sort of thing, one that differentiates it from, say, the rack. I nominate "sorture", as a portmanteau of "sort of" and "torture".

The photo above, of the woman in the plank position, comes from sheride.com.

Tuesday, May 12, 2009

China's Economic Transition

China's exports were down 22.6% year-over-year in April, continuing a six month negative trend. That's the obvious cloud in China's economic forecast, but in an article in yesterday's Financial Times ("Chinese tap an inner dynamic to drive growth"), James Kynge highlighted the silver lining:

Just as the US during the 19th century underwent a transition from export-oriented growth to a greater reliance on inner dynamism, so China is looking inwards for the engine to drive its economy.

In China's case it is still early days, but evidence suggests the conventional view of an export-dependent, river delta-driven economy no longer matches the reality. The argument here is not that trade has somehow become unimportant to China, but rather that the energy generating the world's fastest economic growth rate this year is increasingly coming from within.

A series of indicators reveals the shift to "China Continental" - the transition of the world's most populous country into an increasingly self-propelling economic force. There are caveats, of course, but first the evidence.

Retail sales have held up much better in China this year than in other big economies, growing at a real 15.9 per cent in March year-on-year. But more important than the overall trend is the composition of the retail spending.

The most robust consumer spending figures are coming from inland and lower-tier cities rather than from the traditional growth powerhouses clustered around the Yangtze and Pearl river deltas.

Kynge also notes another sign of this transition, "that domestically bound cargo traffic through ports is increasing year-on-year, while foreign trade volumes are slumping".

The photo above, of a Wal-Mart in Chongqing, comes from the USDA's Foreign Agricultural Service. Chongqing is one of the lower tier cities Kynge referred to in his article.

Alloy Steel's 10-Q

Alloy Steel International (OTC BB: AYSI.OB) filed its 10-Q today (summary; full filing). Another break-even quarter: $39,000 of net income on $1,479,774 of sales. As I mentioned in a recent post ("Run Silent, Run Deep"), I had expected a loss this quarter, so I'm (mildly) pleasantly surprised the company was able to break even during what might turn out to have been the worst quarter of the current global recession. Judging from the price action today though, others had higher expectations. Management offered this comment on the quarter and the company's prospects going forward:

The decrease in sales for the period is representative of the general downturn being experienced in the world economy. The number of orders received by the Company have declined as demand for our product reduced as various mining companies announced that new mining projects were being delayed and/or existing mining projects were being wound back until demand for commodities increased. The Company has submitted tenders for the supply of Arcoplate where possible and is confident that these will be successful with orders likely to be received in the next three to six months. The Company has continued to promote its product in the market place as a superior option for maintenance, as well as seeking entry into other markets which were previously limited by the Company’s ability to meet the demand existing prior to the economic downturn. The Company is confident of being able to present its product well in these new markets, and anticipates additional orders will be generated from these new locations.

Updated Altman Z-Score for Alloy Steel

In a previous post ("Using the Altman Z-Score to Calculate the Risk of a Company Going Bankrupt"), we described the Altman Z-Score model for manufacturing companies:

The Altman Z-Score is a model developed in 1968 by NYU Finance professor Edward Altman (pictured above) to predict the likelihood of a company going bankrupt within the next two years. According to Investopedia,[R]eal world application of the Z-Score successfully predicted 72% of corporate bankruptcies two years prior to these companies filing for Chapter 7"

In creating the Z-Score model, Professor Altman studied an initial sample of 66 firms, half of which had gone bankrupt, and looked for the balance sheet and income statement ratios that had the most predictive value. Dr. Altman settled on these five ratios1:T1 = Working Capital / Total Assets

T2 = Retained Earnings / Total Assets

T3 = Earnings Before Interest and Taxes / Total Assets

T4 = Market Value of Equity / Total Liabilities

T5 = Sales/ Total Assets

He then assigned weightings to them based on their predictive values to create his model:Z Score Bankruptcy Model:Z = 1.2T1 + 1.4T2 + 3.3T3 + .6T4 + .999T5

Based on this model, a Z-score below 1.8 means bankruptcy is likely within two years; a Z-score between 1.8 and 2.99 is a gray area; and a Z-score above 2.99 means there is little likelihood of bankruptcy within the next two years.

In that post, we noted that the Altman Z-Score for Alloy Steel at the time was 4.89. I re-ran the calculation today using the updated numbers and got an Altman Z-Score of 4.19. Unsurprisingly, it's lower than last time, given the drop off in sales and earnings, but still well above the 2.99 level, above which the model predicts little likelihood of bankruptcy within the next two years.

Saturday, May 9, 2009

Gaseous Anomaly?

And this is a three month chart comparing them:

It makes sense for the share price of the royalty trust to decline as natural gas prices have declined (the natural gas ETF closely tracks natural gas prices), but I don't know what the explanation is for the recent divergence. It is possible, of course, that the trust's distributions could rise if an increase in production outweighs the drop in natural gas prices, but I don't know of any estimates of future production increases for this trust.

1About 90% of this trust's royalties come from natural gas production, with the balance coming from oil production.

An African Perspective on Economic Development

From an op/ed in Friday's Financial Times by Paul Kagame, the president of Rwanda ("Africa has to find its own road to prosperity"):

[A]s I tell our people, nobody owes Rwandans anything. Why should anyone in Rwanda feel comfortable that taxpayers in other countries are contributing money for our wellbeing or development? Rwanda is a nation with high goals and a sense of purpose. We are attempting to increase our gross domestic product by seven times over a generation, which increases per capita incomes fourfold. This will create the basis for further innovation and foster trust, civic-mindedness and tolerance, strengthening our society.

[...]

Entrepreneurship is the surest way for a nation to meet these goals. Government activities should focus on supporting entrepreneurship not just to meet these new goals, but because it unlocks people’s minds, fosters innovation and enables people to exercise their talents. If people are shielded from the forces of competition, it is like saying they are disabled.

Entrepreneurship gives people the feeling that they are valued and have meaning, that they are as capable, as competent and as gifted as anyone else.

The rest of Mr. Kagame's column is worth reading. In it, he refers to the ideas of an economist we've mentioned here before, Dambisa Moyo.

A quick check of Wikipedia suggests that Kagame had a long, eventful (and somewhat controversial) military career before entering politics. This year, Kagame was included in Time Magazine's list of the world's 100 most influential people. His entry was authored by the mega church pastor Rick Warren, who wrote (in part),

Kagame's leadership has a number of uncommon characteristics. One is his willingness to listen to and learn from those who oppose him. When journalist Stephen Kinzer was writing a biography of Kagame, the President gave him a list of his critics and suggested that Kinzer could discover what he was really like by interviewing them. Only a humble yet confident leader would do that. Then there is Kagame's zero tolerance for corruption. Rwanda is one of the few countries where I've never been asked for a bribe. Any government worker caught engaging in corruption is publicly exposed and dealt with. That is a model for the entire country — and the rest of the world too.

The photo above, of President Kagame shaking hands with President Bush in the White House in 2006, is from Wikipedia.

Friday, May 8, 2009

PhotoChannel and Facebook

Reader N.L. shared with me the following correspondence he had with PhotoChannel (OTC BB: PNWIF.OB) today.

N.L.'s e-mail to PhotoChannel:

Is it fair to say that Photochannel is no longer in the running for facebook as a company called imagekind seems to be working with them? Any other social networking sites or flickr on the radar screen?

PhotoChannel's response to N.L.:

Thank you for your interest.

While I can’t speak definitively about Imagekind and their relationship with Facebook, it is of no mounting concern for us at PNI.

It seems that they have created a fan-page on Facebook. Artists who sell their art via Imagekind, and are also users of Facebook, can become fans of the fan page, and thereby attract new fans, with the hopes of selling more art via Imagekind. This type of marketing is a common strategy of both big and small companies, including some of PNI’s key customers. Wal-Mart Canada, for example, has a photo gift presence on Facebook already which can be used as an on ramp to further sales.

As a company, we are pursuing corporate level partnerships with leading retailers and sites, including Facebook and Flickr, the two you mentioned. In terms of marketing, we also guide and support our existing partners in devising and implementing messaging and strategies that will drive sales through the PNI platform.

I hope that answers your question.

Simon Cairns

PNI Digital Media

Thursday, May 7, 2009

Two Press Releases from Destiny Media

Destiny Media Technologies (OTC BB: DSNY.OB) issued two press releases within the last several hours.

The first relates to the company's dispute with Yangaroo (TSX Venture: YOO.V), "Destiny Media Responds to Press Release From Canadian Competitor". Excerpt:

VANCOUVER, British Columbia, May 6 /PRNewswire-FirstCall/ -- Destiny Media Technologies, Inc. (OTC Bulletin Board: DSNY - News), the industry's leading secure digital media distribution company, is pleased to respond to a press release issued this afternoon by Yangaroo Inc. (TSX: YOO, Pink Sheets: YOOIF). Yangaroo offers a web based product that competes with Destiny's Play MPE® system in Canada.

According to their release, Yangaroo states that a claim for patent infringement against Destiny was filed in Wisconsin today for a patent issued yesterday. Destiny has not yet been served with this claim but is familiar with this patent and Destiny's management is confident that the claims are without merit. Destiny previously filed a $25 million slander and defamation suit against Yangaroo, for misleading Destiny's customers regarding the limits of Yangaroo intellectual property rights.

Destiny first began offering the MPE® system in 1999 and has its own patent for a Digital Media Distribution Method and System (USPTO 7466823) with foreign priority dating to March 2000. Yangaroo applied for their US patent May 8th 2003, four years after MPE® launched. Yangaroo listed Destiny's MPE® patent as prior art in their own application, clearly admitting that the MPE® system predated their application.

Yangaroo's original patent application was unsuccessful and they received a final rejection on December 15, 2008, forcing them to abandon all 109 of their original claims. They wrote and submitted a new single claim in January 2009 and this single claim patent was granted yesterday. Their new claim describes a method of distributing music that takes a different approach than that used by MPE®.

According to Destiny CEO, Steve Vestergaard, the suit is frivolous and only intended to create confusion in the marketplace. "They say imitation is the best form of flattery, but intellectual property law protects the invention that comes first, so their claims that we might infringe on a claim they only wrote a few months ago are ridiculous. Play MPE® is well on the way to becoming the global standard as over one thousand labels, including all the majors have chosen our system to send their new music to radio and we will protect our customer's ability to use the system they prefer."

The second press release announces a new deal in Australia, "Destiny Media Announces Partnership Between Play MPE(R) and Australian Independent Record Labels Association". Excerpt:

VANCOUVER, British Columbia, May 7 /PRNewswire-FirstCall/ -- Destiny Media Technologies, Inc. (OTC Bulletin Board: DSNY - News), the industry's leading secure digital media distribution company, is pleased to announce that Australian partner, The Shooting Star Picture Company has established a partnership with the Australian Independent Record Labels Association (AIR) to provide media distribution services for Australia's 300+ indie record companies through the Play MPE® music delivery software.

Wednesday, May 6, 2009

Following "Dutch" versus "Going Dutch"

[T]he organizing principle and the crucial alternative to the Democrats -- must be freedom. The federal government is too big, takes too much of our money, and makes too many of our decisions. If Republicans can't agree on that, elections are the least of our problems.

In other words, the GOP should advocate the policies of President Ronald "Dutch" Reagan today. The "freedom" agenda -- the smaller government, lower taxes, and fewer regulations1 -- advocated by Reagan did (along with his spectacular political talents) win him the presidency, and a landslide reelection, but it's worth remembering that when he won the presidency in 1980, it was after decades of government overreach that built upon FDR's activist response to the Great Depression; during the Depression, Reagan himself voted for FDR.

Sen. DeMint continued:

If the American people want a European-style social democracy, the Democratic Party will give it to them. We can't win a bidding war with Democrats.

Coincidentally, the New York Times Magazine published an article on a European-style social democracy over the weekend, a report by Russel Shorto, an American ex-pat living in The Netherlands, on his experiences with the Dutch welfare state ("Going Dutch"). I'm going to address a few points from that article in another post, but first I'll make two meta-points.

The first meta-point is that Sen. DeMint's focus on freedom (with respect to economic policy) despite its merits, may be a tough sale today, given that we are in the longest post-WWII recession, unemployment is headed for double digits, and most Americans have seen the values of their homes and retirement accounts drop more steeply than they have in generations. I think a more common response to this sort of economic uncertainty is a desire for more security, not more freedom. If I were a Democratic political strategist, I'd have a field day with DeMint; the talking points almost write themselves. E.g., "We want to give you affordable health care; Sen DeMint and the Republicans want you to have the freedom to pay for it yourself." Certainly, Republicans ought to propose market-based alternatives where possible, but keeping in mind the current economic uncertainty, a better way to frame these alternatives might be to use a phrase such as "choice2 and security".

The second meta-point is that, despite the views of hardcore libertarians, capitalism can and does coexist with welfare state policies of one form or another. Social democracies such as Denmark and The Netherlands score highly on the Heritage Foundation's Index of Economic Freedom (numbers 8 and 12, respectively, out of 179 countries ranked), and even Hong Kong and Singapore -- the highest rated countries on the index -- have social safety net policies (although they are based more on enforced savings than income redistribution). To his credit, Shorto makes a similar point in his New York Times Magazine article, noting that the Dutch have a long history of being innovative capitalists, and remain capitalists today.

1Today, "regulation" often connotes a law designed to promote public safety, but it's worth remembering that a number of the regulations Reagan (and Carter before him) opposed were ones designed more to limit competition and fix prices (e.g., regulations on airfares and stock commissions).

2Conservative advocates of school vouchers have already co-opted the word "choice" from liberal advocates of unrestricted abortion by calling voucher plans "school choice".

KSW Reports Q1 Earnings

From the company's press release, after today's close ("KSW, Inc. Reports First Quarter 2009 Results"):

LONG ISLAND CITY, N.Y.--(BUSINESS WIRE)--KSW, Inc. (NASDAQ: KSW - News) today reported financial results for the first quarter of 2009.

Total revenue for the first quarter of 2009 was $19,706,000 as compared to $20,491,000 for the first quarter of 2008. Net income was $287,000 for the first quarter of 2009 as compared to net income of $840,000 for the first quarter of 2008. This represents earnings per share of $.05 per share (basic and diluted), for the first quarter of 2009 as compared to an earnings per share of $0.13 per share (basic and diluted), for the first quarter of 2008.

As of March 31, 2009, the Company’s backlog was approximately $38,300,000, which does not include the Mt. Sinai Center for Science & Medicine Project, which is currently estimated to have a value between $58 and $61 million. KSW has been notified that the Owner has approved the Company as the trade manager for the construction phase of the project. However, the final contract value has yet to be determined and contract documents have not yet been executed. The March 31, 2009 backlog also does not include two upper west side contracts, which were terminated by the Owner in March 2009. The Company, with the help of union concessions, was able to negotiate new agreements for the completion of those two projects[1].

Chairman of the Board, Floyd Warkol, commented: “Our first quarter revenue and income were impacted by the economic recession and credit crunch, which directly resulted in the cancellation of several large projects. However, our cash position remains strong, and we have aggressively begun bidding on public sector work, where opportunities for new work should expand under the Federal Government’s stimulus program.”

I'll be interested in seeing what the company's balance sheet looks like when it files its 10-Q for the first quarter.

[1]The press release doesn't offer a dollar amount for these two UWS projects, but I wonder if this is the $8.5 million in business KSW corporate counsel Jim Oliviero mentioned in our previous conversation, which we noted in a post at the end of March (KSW Update):

$8.5 million of [the backlog] was terminated by a developer. Oliviero explained that the developer was attempting to negotiate lower costs with the unions, and KSW was hopeful about getting the project back on the backlog if that can be done.

I left a voice mail with Oliviero today and will ask him this if I hear back from him tomorrow.

The Stock Also Rises

As a commenter on the company's Investor Hub message board noted, Alloy Steel International (OTC BB: AYSI.OB) was up 39.29% today on 6x average volume. It's nice to see the stock move up for a change, particularly with its earnings release expected next week, but I think this says more about the inherent volatility of an illiquid, low-float, micro-cap stock than anything else. I still expect the company to post a loss when it reports its quarter. Maybe there will also be some encouraging forward-looking statements though. We'll see.

Tuesday, May 5, 2009

The Perils of Straying into Politics

In an article in the Arts section of the New York Times last week ("Equal Pay Agitator Meets the New Her"), about the new musical "9-to-5", Patrick Healy editorialized that a character in the 1980 film on which the musical was based,

emerged during the Reagan era as a symbol for women seeking equal treatment in the workplace.

On Sunday, letter writer Mark Richard responded (Letter: ‘9 to 5’: A Reagan-Era Symbol?"):

Re “Equal-Pay Agitator Meets the New Her” by Patrick Healy [April 26]:

Mr. Healy writes that the character of Violet “emerged during the Reagan era as a symbol for women seeking equal treatment in the marketplace.”

The character of Violet was created in December 1980, when the film of “9 to 5” was released, a month before Reagan took office. Apparently the behaviors deplored in the film predated his Republican administration, as they were set during the Carter years, when the Democratic Party had overwhelming control of government at almost all levels in the United States.

If Violet “emerged” as a “symbol” afterward, she was not a very persuasive one: Democrats controlled the White House for eight of the years since the film was released and the Congress for 16 of those years, without the political measures embodied in the Lilly Ledbetter Fair Pay Act being enacted.

The implication that Violet became a symbol in opposition to the “Reagan era” is an example of the use of cultural narrative in the service of rather small-minded political partisanship — a trend that is limiting the usefulness of much commentary seeking to relate artworks to the real world.

Mark Richard

Columbus, Ohio

I wasn't familiar with Patrick Healy, and gave up looking for his bio after a few minutes on Google and the NY Times site, but he appears to be a young, former political reporter. The chief theater critic of the Times, the 54-year-old Ben Brantley, who is old enough to remember the zeitgeist of the 1970s, placed the '9-to-5' story squarely in the 70s in his recent review of the musical:

Though released in 1980, the movie, directed by Colin Higgins from a script by Ms. Resnick, feels very much a 1970s artifact. It reflects a time when the feminist movement (or the idea of it) was starting to settle comfortably into suburbia.

The photo above, of 9-to-5 cast members Megan Hilty, Allison Janney and Stephanie J. Block, is credited to Sara Krulwich/The New York Times.

Monday, May 4, 2009

Penny Ante Arbitrage Update III

In previous posts ("Penny Ante Arbitrage" and "Penny Ante Arbitrage Update") I mentioned that I bought 749 shares of Asure Software (Nasdaq Capital Market: ASUR) at between 17 and 18 cents per share in several different accounts, in the hopes of getting them cashed out at 36 cents each after the company's proposed 750-1 reverse split (the first step in the company's plan to go private). Today, a hedge fund issued a press release ("Pinnacle Fund Issues Letters Requesting Asure Software Abandon its Pending Go-Private Transaction, Requests Shareholder List.") opposing the company's plan to go private. Excerpt:

NEW YORK, May 4 /PRNewswire/ -- Pinnacle Fund (controlled by Pinnacle Partners, LLC which is partly controlled by Red Oak Partners, LLC) announced today that it has issued two letters to Asure Software ("ASUR" or the "Company") requesting that its concerns be addressed, including: a) calling a 2009 annual meeting - thus far ASUR's Board has failed to call nor indicated its intention to call such a meeting; b) excess compensation at the senior management level; c) increasing shareholder representation on a Board which currently has very low insider stock ownership and representation along major shareholders; c) the inability of management to historically forecast its business; and d) an imprudent going-private transaction despite the Company's ability to realize the bulk of ASUR's stated cost savings while remaining public as well as to save additional monies by not paying out certain stockholders at 2x current market price levels. Pinnacle's first letter was issued on April 17th, 2009, followed by a second letter and a shareholder list request issued on May 4, 2009. The letters ask for "immediate and radical changes in the cost structure" to better align costs with revenues and that ASUR abandon its pending go-private transaction and instead effect immediate changes - inclusive of Board changes, setting a date for its annual meeting, and enacting both a reverse stock split in order to satisfy NASDAQ minimum price requirements and an active stock repurchase program.

David Sandberg, the portfolio manager of the Pinnacle Fund, further states, "We would still like to work with the Company's current board and management to address and resolve our concerns. But unless the board and management withdraw from this go-private proposal and map out a workable strategy to restore profitability, our ability to work together appears limited and a proxy fight more inevitable."

According to its 13-D amended today, Red Oak Partners owns 7.35% of the outstanding shares of Asure Software (Nasdaq: ASUR), which it acquired this year. In its two recent letters to Asure's management, Red Oak criticized the company's recent mismanagement, and questioned whether it was necessary to go private to achieve significant cost savings. For example, Red Oak noted that, as a micro-cap company, Asure could save money by hiring a less expensive, smaller auditing firm than Ernst & Young.

David Sandberg of Red Oak Partners was kind enough to spend a few minutes on the phone with me discussing this today, and, in addition to reiterating some of the points in his two letters to Asure's management, he mentioned that he invested in this stock with a higher price target in mind than 36 cents per share. He said that he could have easily had an assistant open a bunch of accounts holding 749 shares each, but he thought he could unlock more value by getting more effective management in place. He noted the cash on the company's balance sheet, that both of the company's businesses are high-margin ones, and said he thought a 70 cent price target was reasonable for the stock, given more effective management.

I'd be happy to take the 36 cent bird in the hand over the 70 cent birds in the bush here, and I imagine most small shareholders would be as well. We'll see what happens.

Something to Cheer up my New British Readers

1Since the embedding was disabled for "Manchester", I substituted it with the video to "You keep it all in", from 1989, about 18 years before I ever heard of The Beautiful South. Back in '89, I was listening to Sonic Temple on my Walkman. Update: Now substituted with a concert video of the same song from 1997, preceded by a few seconds of interviews, since YouTube took down the original video.

2Hat tip to Cheryl for introducing me to this since-disbanded Brit-pop group. We saw them live once at Irving Plaza in New York, shortly before the band broke up.

Hussman's Latest

In In his latest market commentary, "Comfortable with Uncertainty", Dr. Hussman shares some thoughts on dealing with market uncertainty, describes a new autism-related discovery by the Miami Institute for Human Genomics (with which Hussman is involved via his eponymous foundation), mentions that he was the subject of a Money magazine profile (though doesn't link to the article), and throws in a little self-deprecating humor to boot. A few brief excerpts:

In In his latest market commentary, "Comfortable with Uncertainty", Dr. Hussman shares some thoughts on dealing with market uncertainty, describes a new autism-related discovery by the Miami Institute for Human Genomics (with which Hussman is involved via his eponymous foundation), mentions that he was the subject of a Money magazine profile (though doesn't link to the article), and throws in a little self-deprecating humor to boot. A few brief excerpts:On dealing with uncertainty:

In his book On Being Certain, neurologist Robert A. Burton quotes F. Scott Fitzgerald – “The test of a first rate intelligence is the ability to hold two opposed ideas in the mind at the same time and still retain the ability to function.” Buddhist teacher Pema Chodron calls it “being comfortable with uncertainty” – being willing to take every aspect of reality as the starting point, without wasting energy wishing things were different, without denying reality as it is (even if your next step is to work toward changing things), and without needing to know what will happen in the future. “The truth you believe and cling to makes you unavailable to hear anything new. The best thing we can do for ourselves is to be open to an unknown future.”

Burton offers the same advice. Tolerating the unpleasantness of uncertainty, he writes, “is the only practical alternative to cognitive dissonance, where one set of values overrides otherwise convincing contrary evidence. Each position has its own risks and rewards; both need to be considered and balanced within the overarching mandate: Above all, do no harm. Science has given us the language and tools of probabilities. We have methods for analyzing and ranking opinion according to their likelihood of correctness. That is enough. We do not need and cannot afford the catastrophes born out of a belief in certainty.”

Hussman humor:

See, I really can write a whole weekly comment without repeating that the bondholders of mismanaged financial companies should be required to accept debt-for-equity swaps or haircuts, with the alternative being government receivership. Didn't even mention it.

Oops.

The photo of Hussman above, by Nigel Parry, accompanied the Money article ("Best Bear Market Fund Manager Around") to which Dr. Hussman (perhaps in his excitement about the autism discovery) apparently forgot to include a link in today's market commentary.

Sunday, May 3, 2009

Hatton v. Pacquiao

- I'm glad I didn't pay $49.95 to see this live.

- The outcome doesn't surprise me, though I wouldn't have expected it to end as soon as it did. Pacquiao's right hook that dropped Hatton the first time was a thing of beauty. It reminded me a little of the left hook Mayweather knocked out Hatton with in his fight; Hatton didn't see either of those punches coming.

- I have never been too impressed by Hatton. He's a busy, aggressive fighter, but that's about it. I was surprised to see him defeat Kostya Tszyu and Jose Luis Castillo1 in previous -- two great fighters, but, in hindsight, Hatton fought them when they were past their primes.

- Pacquiao is now arguably the best pound-for-pound boxer in the world. That distinction has been Floyd Mayweather, Jr.'s for the last few years, but considering the way Pacquiao dispatched Hatton and Oscar De La Hoya -- with a second round knockout and and eighth round TKO, respectively -- versus Mayweather's 10th round knockout of Hatton and split decision over De La Hoya, Pacquiao looks more impressive right now. Of course, this sets up a huge pay-per-view fight between the still-undefeated Mayweather and Pacquiao.

- What was Hatton thinking hiring Floyd Mayweather, Sr. to train him for this fight? If you have seen Mayweather, Sr. (who is estranged from his son, the boxing champ mentioned above) on television, you'll know what I mean. He doesn't seem to be all there.

- If Hatton had a better chin, he might be able to look forward to a future as the Arturo Gatti2 of Manchester: a club fighter who sells out local arenas while getting beaten soundly by top boxers.

- How long until someone in the media analogizes Hatton's boxing career -- which began its current downward trajectory in 2007, after a long streak of victories -- to the recent trajectory of Britain's economy? Maybe a British financial journalist will argue that, as with Hatton's early successes, there was less to Britain's finance- and real estate-fueled boom than met the eye.

1Castillo fought two fights against Diego Corrales, the first of which might have been the best fight in the last decade. At the time of his defeat by Hatton, he may have been distracted by events outside the ring, including a lawsuit by the Corrales family (Castillo caused a third fight between the two to be delayed, and then Corrales was killed in a motorcycle accident before it could be rescheduled).

2Gatti has since retired, but before he did he fought a series of fights with Micky Ward, the first of which was about as good as Castillo vs. Corrales I.

Saturday, May 2, 2009

An Astronomer with a Sense of Humor

A humorous letter to the editor in today's Financial Times, "Buy me a massive telescope or pay the consequences":

From Dr Charles BeichmanSir, “Give me a billion dollars for my accelerator or I’ll kill your economy.” These words should strike terror into the hearts of bureaucrats everywhere. And the next time they hear them, those responsible for funding big science should immediately just hand over the money.

As your article (“Of couples and copulas,” April 25) on David Li[1] describes, the flood of theoretical physicists, aka the “quants”, coming into Wall Street after the cancellation of the SuperConducting Super Collider (SSC) created the financial weapons of mass destruction whose power to annihilate wealth is now obvious.

With the loss of trillions of dollars throughout the world economy, how much safer we all would have been if Congress had just paid the ransom over a decade ago and kept all those physicists safe in their laboratory at the Waxahachie, Texas, site of the SSC. So, please, listen carefully when I say that we have one or two major space telescopes that need funding. Otherwise I might consider moving to Wall Street.

Charles Beichman,

Executive Director,

Nasa ExoPlanet Science Institute,

California Institute Of Technology, US

The image above, of David Li's Gaussian copula function, comes from the Wired article by Felix Salmon linked to in the footnote below.

[1]Creator of the Gaussian copula default function ("the formula that killed Wall Street").