Birmingham-based Regions Financial will acquire Integrity’s $974 million in deposits, the FDIC said. Integrity customers will have access to their accounts and no interruption of service is expected, the FDIC said. Integrity’s five branch offices will reopen Tuesday as Regions offices and customers can continue to use those locations, the FDIC said.

However, the matter may not be over. The FBI, which investigates possible financial crimes, is looking into the situation, said agency spokesman Stephen Emmett. The “FBI is working with the FDIC” on the case, but it “is not prepared to discuss Integrity Bank at this time,” he said.

The Alpharetta-based bank, which opened its doors in 2000 with a Christian-centered philosophy, is the 10th U.S. bank to fail this year and the second Georgia institution to fail in the past 12 months.

Saturday, August 30, 2008

Banks Update, Part II

Friday, August 29, 2008

Sarah Palin, Todd Palin, and the benefits of Increasing Domestic Energy Production

Until recently, he earned hourly wages as a production operator in a BP-run facility that separates oil from gas and water. Palin was making between $100,000 and $120,000 a year before he went on leave in December to make more time for his family and avoid potential conflicts of interest. London-based BP is heavily involved in the gas pipeline negotiations with his wife's administration.

That's good money for honest work, and, as I've pointed out in comments on some political blogs, it's another benefit of increasing domestic energy production: more high-paying blue collar jobs for Americans2. To his credit, Mr. Palin has encouraged young Alaskans to consider the same line of work. From the article,

Like other first spouses around the country, Palin has been asked to champion an array of causes or institutions since his wife took office in December.

His favorite is steering young Alaskans toward stable jobs in the oil and gas industry. It's a singular choice among his counterparts, whose pet issues include schools, public health, domestic violence, poverty or the arts.

That's the sort of pragmatic career advice you don't hear much of from many politicians, particularly those on the left, many of whom seem to consider access to a college education to be a panacea for economic advancement. In reality, a lot of Americans don't have the interest or aptitude for college (hence the high dropout rates), or the sorts of jobs a college degree often leads to, and there are plenty of Americans with college degrees sitting in cubicles making a third of what Palin was making for BP, or serving lattes for $8 per hour.

Regarding the politics of the Palin pick, a flurry of comments on the Atlantic blogs argue that this is an attempt by McCain to woo women voters. I doubt that. Most single women vote for Democrats, and most married women vote for Republicans; I don't see this pick changing those trends much. If anything, McCain's selection of Sarah Palin is an appeal to the sort of Reagan Democrats that Barack Obama had difficulty winning over in states like Pennsylvania. While Republican politicians generally feel compelled to be seen hunting or clearing brush or otherwise acting as if they enjoy outdoorsy activities, Sarah Palin seems to be the real deal on that score, having grown up hunting moose with her father. She and her husband ought to be able to connect more easily with rural voters than, say, Mitt Romney. Louisiana's impressive young governor, Bobby Jindal, might have contributed more in policy terms, but Palin probably gives McCain a better shot of winning in November.

1A royalty trust that pays out distributions based on production from BP's Prudhoe Bay field on the north slope is a holding of mine I've mentioned here before, BP Prudhoe Bay Royalty Trust (NYSE: BPT)

2There are other benefits, of course. Every barrel of foreign oil that we can replace with a barrel of domestic oil helps reduce our trade deficit and our fiscal deficit as well (by the increased tax and royalty revenues domestic energy production generates). No, increasing domestic energy production will not make us energy independent -- we will still need to import oil from Canada, Saudi Arabia, etc. But the more energy we can produce here, the better off we will be.

Thursday, August 28, 2008

The Mystery of Sears

Sears Holdings (Nasdaq: SHLD) announced another desultory quarter today (AP: "Sears' 2Q profit drops 62 percent"). No mystery there. The mystery I refer to in the title of this post is what well-respected professional investors such as Bruce Berkowitz see in the company. I've heard the pitch that Eddie Lampert is a great asset allocator, and Sears has great assets in its brands and its real estate, but I don't see it. I have no idea what its brands are worth, but their association with a shabbily run retailer can't be making them more valuable. Whatever the real estate was worth a few years ago, it's certainly worth less now, and, in any case, this would seem to be an inauspicious time to try to monetize it.

Truth be told, I considered buying puts on SHLD when the stock was trading at $80, but my procrastination in filling out the options paperwork at my brokerage prevented me from doing so. At this point, I think I'll continue to hold off. As long as fund managers such as Berkowitz are intent on maintaining Sears as a core holding, that could continue to support the stock. If one of these prominent investors decides to dump Sears though, things could get interesting. There seems to be something of a herd mentality at work here, with one investor's conviction in the company reinforcing another's.

The photos above are of the Sears in Hackensack, and I took them all today. The first one came out much better than I expected, considering the technique I employed, which was simply holding a digital camera out of my open sun roof as I drove toward the building and vaguely aiming it at the Sears tower. Apparently this sort of free-standing Sears building is relatively rare. I believe this one was built in the 1930s.

The second photo was taken using a similar sun roof technique, except that time I was aiming the camera vaguely backward and to the right as I drove past. That photo is of the Sears building's Main Street entrance, which for some reason Sears doesn't use. It's now a bus stop, so the woman in the photo is presumably waiting for a bus.

The third photo is more prosaic, but it gives you an idea of how business is going at Sears Brand Central on a typical weekday afternoon in Hackensack.

Q2 GDP Was Even Higher than Brian Wesbury Predicted

Wednesday, August 27, 2008

Gas Prices, Tipping Points, and Demand Destruction

The Valero station above is where I usually fill up, since most of the time it has the lowest prices in the area. Gas prices peaked here a couple of months ago at $3.939, so to see them drop to $3.399 this week was a relief. Last year, when gas prices peaked here at around $3.159, I remember how high that seemed at the time, and that I tried to drive less. Now, after paying $3.939 per gallon two months ago, paying $3.399 seems like a deal. I don't think about gas prices much now when I decide whether or not to drive somewhere.

Thinking about this, I recalled recent columns claiming that $4 per gallon gas was the tipping point into demand destruction, so the corresponding oil price (~$149 per barrel) was the peak (some columnists went further, and claimed that oil was on its way back to $70 or less per barrel). A problem with the tipping point concept, as my reaction above demonstrates, is that the mind adjusts, so tipping points are a moving target. $4 gas may have been the tipping point that caused Americans to drive less this year, but next year that tipping point might be $4.30, and the next year $4.50, and so on.

That's just us, of course. The rest of the world has plenty of drivers, and many of them in developing and oil-producing countries have gasoline subsidies that insulate them from the effects of higher oil prices.

Tuesday, August 26, 2008

PhotoChannel Reports

As expected, PNWIF put up some crazy growth numbers and had higher expenses as they integrated Costco and Sam`s club.

The key takeaways include:

1)They averaged over 21,000 transactions a day in the second quarter more than Shutterfly. And once Costco was on, they were averaging over 30,000 on the last day of June and as of yesterday they are now over 40,000 a day. Can you say growth?

2)They are finally cash flow positive.

3)There are 25,000 locations in Asia that Kodak has identified for Photochannel that they can use Photochannel`s help. This includes Kodak India, Kodak Australia, Kodak Japan, Kodak Taiwan and Kodak China. I don`t think that I have really describe the upside of this or the value of Photochannel`s technology if Kodak is relying on them so much.

4)While expenses were higher than I expected in the quarter it was not surprising considering the bumpiness and tardiness of the Costco launch. I actually expect expenses to slowly moderate over the coming quarters.

5)With 30% organic growth, and 247% growth with only two weeks of Costco, look out for how much the company will grow in its September and December quarters considering the seasonal benefit coming.

6)With Asia, a new CEO, and a small acquisition that should lead to new business, the future is just very, very bright for PNWIF.

The end of this year and next should be [good ones;] sit back and watch the company`s performance really take off.

Sunday, August 24, 2008

Banks Update

Above is a photo of the new branch I mentioned that Pascack Community Bank (OTCBB: PCCB.OB) is building in Hackensack, NJ (I snapped this photo out of the sun roof in my car as I was driving by, hence the poor quality). When I mentioned this initially in another earlier post ("America's Smartest Banker"), I assumed that building a new branch was a positive sign for a bank. Perhaps I shouldn't have assumed that. In doing some research on one of the banks that I mentioned as a potential short idea in a recent post ("The Strongest and Weakest Banks in America"), I found out that one of those "weakest" banks, Beach Community Bank in Florida (OTCBB: BCBF.OB) is building a new branch as well. From Beach Community's website:

We are presently under construction with a new branch coming soon to Crestview.

USEG Update

One question that a shareholder asked on the conference call was whether the company would consider using some of this cash horde to pay out a special dividend. USEG CEO Keith Larsen said he'd mention it to the board, but also pointed out that cash is fairly hard to come by in today's credit environment, so it's helpful to have it on the balance sheet to take advantage of investment opportunities that may come up.

Friday, August 22, 2008

"Ten Financial Entities on the Brink"

Thursday, August 21, 2008

The Fastest Growing Privately-Held Companies

Some of the companies on this list will eventually go public, of course, and the list gives you a chance to hear about them before that happens.

Wednesday, August 20, 2008

All About Molybdenum

About Molybdenum

What is Molybdenum?

* Element 42 (symbol Mo) on the periodic table

* Very high melting point (2,610 degrees C)

* Usually occurs in ore bodies as Molybdenite (MoS2)

* Mined by itself or with other metals such as copper

* Milling converts ore into molybdenum concentrate

* Concentrate roasted at 600 degrees C to remove sulfur

* Final product is technical grade molybdenum oxide

* 'Tech oxide' sold as powder or briquettes

* Sometimes combined with iron to form FeMo (ferromolybdenum)

* Prices quoted are for contained Mo

* Largest producers are USA, China and Chile

History

* Identified as an element in 1778 by Carl Wilhelm Scheele

* Produced in a metal powder by reduction in 1782 by Peter Jacob Hjelm

* First application in 1910 as a filament support for incandescent lamps

Main Uses for Molybdenum

* Strengthens steel

* Powerful anti-corrosive in steel

* Improves weldability

* Reduces brittleness, stress-cracking

* Helps steel perform in very high or low temperatures

* Small amounts added to steel can reduce total tonnage needed

* Key ingredient in high-end stainless steel (ex. 316, duplex)

* 316 stainless generally has 2-3% Mo by weight

* Mo content in duplex steel ranges from 0.6% to 4.8% by weight

* Mo-bearing pipeline steel has up to 0.5% Mo by weight

* Mo catalysts used by refineries to reduce sulfur in gasoline and diesel

Market for Molybdenum

* Worldwide molybdenum consumption about 422 million lbs in 2006

* Dollar value of market currently $14 billion+

* Consumption growth: 4% average annual rate in past 50 years

* Recent pickup in growth: 5.6% average annual rate 2002-2006

* 2006 growth in consumption: 5.8%

Worldwide trends supporting molybdenum use

* Capital spending boom in energy

* Growing need for pipelines, offshore oil and gas, nuclear power

* Regulations requiring less sulfur in gasoline and diesel

* Moly-bearing steel mandated for nuclear plant retrofits

* Automakers seeking reduced weight, enhanced passenger safety

* Ongoing drive to lower costs via reducing total tonnage used

Tuesday, August 19, 2008

USEG Update

As I mentioned in the comment thread of an earlier post ("A Conversation with the CEO of USEG"), the company's plan had been to partner with a larger mining company that would cover the bulk of the development costs of the Lucky Jack molybdenum project in return for the bulk of the potential proceeds from the mine; the agreement announced today gives Thompson Creek (NYSE: TC; TSX: TCM.TO) the option to be that partner. Under the terms of the agreement, if USEG and Thompson Creek develop the mine, Thompson Creek has the option of acquiring up to a 75% interest in the mine if it spends $393.5 million in development costs and pays USEG $6.5 million in option payments.

Monday, August 18, 2008

The Strongest and Weakest Banks in America

FCEN.OB

BCBF.OB

FMNTQ.PK

DSL

FDT

FLCM.OB

ITYC.PK

Sunday, August 17, 2008

"Suburbia Comes to China"

THE FRANTIC PACE OF URBANIZATION has been the transformative engine driving this country's economy, as some 300 million to 400 million people from dirt-poor farming regions made their way to relative prosperity in cities. Within the contours of that great migration, however, there is another one now about to take place less visible, but arguably no less powerful. As China's major cities -- there are now 49 with populations of one million or more, compared with nine in the U.S. in 2000 -- become more crowded and expensive, a phenomenon similar to the one that reshaped the U.S. in the aftermath of World War II has begun to take hold: A rapidly expanding middle class seeks a little bit more room to live at a reasonable price, maybe a little patch of grass for children to play on or a whiff of cleaner air as the country's cities become ever more polluted.

The Levittowns now springing up across China (ten so-called satellite cities are going up around Shanghai alone) promise to have enormous consequences not just for China but for the global economy. It's easy to understand the persistent strength in commodity prices steel, copper, lumber, oil when you realize that Emerald Riverside [the ~140-house development Powell's townhouse is part of] alone requires more than three tons of steel in the houses and nearly a quarter of a ton of copper wiring. And as Lu Hongjiang, a vice president of the New Songjiang Development & Construction company, puts it, "We're only at the very beginning of this in China."

The box story notes that Emerald Riverside is one of only 50 developments in New Songjiang:

New Songjiang alone will consist of more than 50 housing developments, which require 7,500 tons of steel for buildings, 1,100 tons of copper, and 100,000 tons of cement. Is it any wonder commodity prices are so high?

Regarding the mortgage situation there, Powell writes,

No subprime, "no money down" loans here. We got an off-the-shelf mortgage from the Standard Chartered Bank branch in town, plunked down 25% of the purchase price, and bought ourselves a piece of the Great Chinese Dream.

Saturday, August 16, 2008

"Dr. Doom"

“You either nationalize the banks or you nationalize the mortgages,” he said. “Otherwise, they’re all toast.”

That seems a little hyperbolic. In a recent post ("America's Smartest Banker") we mentioned a few local banks that seem to have weathered the credit crunch fine, and are still making mortgage loans. Surely there are other local banks around the country that have been prudently run as well. In another recent post ("Profiting from the Credit Crunch/Real Estate Bust") we noted entrepreneurs in nearly opposite corners of the country making money by buying distressed mortgages. Why won't this sort of approach -- expanded as more seek profits in distressed mortgages -- eventually mop up most of the mortgage mess? Granted, when the dust settles, mortgages won't be as widely available as they were before to those with poor credit or those unable to make down payments, but a return to more rational lending standards will be a good thing for the financial system and the country as a whole.

James Altucher's Chinese Stock Picks

Giant Interactive (GA)

China Precision Steel (CPSL)

Cogo Group (COGO)

China BAK Battery (CBAK)

Shengdatech (SDTH)

Friday, August 15, 2008

"America's Smartest Banker"

Hudson City banks the old-fashioned way: It takes deposits and makes mortgages to people who buy homes in which they plan to live. And then it hangs on to them. No subprime, no securitization. Hudson City's bankers are steady daters in a wham-bam-thank-you-ma'am era. "We don't have Wall Street bundle up the mortgages and sell them to someone in Norway," [Hudson City CEO Ronald] Hermance says. "We're going to live with those loans." As a result, Hudson City maintains higher standards.

My question about this article is whether Hudson City really is unique in this regard. My bank, NVE Bank (which, after 121 years, has expanded to all of 12 branches throughout Bergen County's Northern Valley) also eschewed securitization, and seems to be weathering the credit crunch fine (here's the bank's latest Statement of Condition).

Another local bank that seems to be doing alright is Pascack Community Bank, which is almost finished building a new branch in Hackensack. I turns out Pascack is publicly-traded (OTCBB: PCCB.OB)

Thursday, August 14, 2008

Forbes Interview with Bruce Berkowitz

[Forbes] But investors might be worried about committing capital to pharmaceutical and managed care companies because we don't know who will be in the White House next year and what that change in administration will mean for these industries.

[Berkowitz] So there is a simple question: Who else will do it? Barack Obama talks about having health care like they have in Congress. Who does the health care in Congress? It's the HMOs. The government can only write a check. When all you can do is write a check, you can't control costs.

When the government is the only one writing a check, it doesn't need HMOs to control costs -- it can simply write a smaller check. That (along with rationing) is essentially how "single payer" systems control costs, and that is the direction in which some mainstream Democrats want to go (for example, my local Congressman, Steve Rothman, has advocated expanding Medicare to everyone). Therein lies the political risk in investing in HMOs, in my opinion.

Wednesday, August 13, 2008

Profiting from the Credit Crunch/Real Estate Bust

Typically, Biltmore buys loans at about 50 cents on the dollar, although mortgages on truly distressed properties - for example, in Detroit - can be picked up for as little as 10 cents on the dollar.

[snip]

The eight-employee company expects to buy $100 million of mortgage debt in 2008. Benaroya said that could triple in 2009, as more subprime loans go bad. The company works in housing markets all over the nation, though the greatest concentration of bad loans is in the Rust Belt states, where the economy and job markets are troubled, and Florida, California, Arizona and Nevada, where there was a lot of overbuilding.

Although foreclosures have risen in New Jersey, they are nowhere near the rate in those distressed markets.

Ilan Kaufthal, a member of the board of Biltmore Capital, said he expects high returns in this business for the next year or two, because non-performing mortgages can be bought at such deep discounts.

"I think it's an extraordinary opportunity over the next few years for people who have the liquidity and cash to buy these mortgages," said Kaufthal, a former Bear Sterns executive who has also invested in Biltmore.

Last month, a similar article about entrepreneurs investing in distressed mortgages appeared in the OC Register, "Investor says only one road to foreclosure profit". Here's an excerpt from that article:

Robert Lee, a Huntington Beach-based investor in distressed home loans, says there is still plenty of pain ahead for the housing and mortgage markets.

Last year I shadowed Lee for a day and wrote a story about it. I had met him at a seminar and was impressed by his enthusiasm for investing in dud loans. Recently he and partner David Phelps have expanded their Web site foreclosuretrackers.com to cover all of Southern California as well as Clark County, Nevada. Last fall, the site just covered foreclosure filings in Orange County.

I quizzed Lee about the mortgage market, his business, and his prediction for a housing rebound. I have a feeling this interview will appeal more to housing bears than bulls.

That interview is worth reading.

Georgia

The Georgian president is impressive – energetic, intelligent and with strong liberal views but, I wonder, how long you can live like this without succumbing to megalomania?

You may find the rest of the article of interest.

Tuesday, August 12, 2008

How Unusual is a 20+% Correction in Oil?

Interesting post by Tim Iacono, "How Unusual is a 'Bear Market' in Oil?":

A story in USA Today today began "Finally, investors have a bear to get excited about. Oil now is in unofficial bear market territory, with the price of a barrel of crude falling to $115.20, down 21% from its July 3 peak."

A good question to have asked prior to writing an article such as this, something that apparently doesn't occur to the new "oil bear market" enthusiasts, is whether a 20 percent decline in the price of crude oil is unusual or statistically significant in any way.

Alloy Steel Issues a Press Release

NEW YORK, NY--(MARKET WIRE)--Aug 12, 2008 -- Alloy Steel International Inc (OTC BB:AYSI.OB - News) -- The directors are pleased to advise that as stated in the company's 10Q for period 9 Months to June 30, 2008, earnings per share this year are 10.7 cents per share compared with 3.4 cents per share for the same period last year, an increase of 7.3c or 214%.

On sales of $9.9 Million (2007 5.3 Million) income before taxes was $2.7 million (2007 0.8 Million), an increase of 1.9 million or 240%.

Alloy's directors are confident that the growth will continue in line with increased production facilities coming on line in August 2008 and the expansion of markets particularly Mongolia.

Investors should be aware that the nature of our business means that the company will always be subject to fluctuations in its quarterly results. It should be remembered that production to date has been carried out on a single mill whilst we have been building the second updated production mill.

Monday, August 11, 2008

Vaalco Energy Reports

Vaalco Energy (NYSE: EGY) reported income of $13 million per share, or 22 cents per share, for the second quarter, versus 6 cents per share in 2Q07 and 3 cents per share in 1Q08 (Vaalco's 10Q).

Vaalco is a Houston-based oil & gas E&P with most of its operations in West Africa, mainly in Gabon. Gabon, according to the CIA World Factbook, is one of the more prosperous and stable African countries, thanks to the combination of plentiful natural resources plus a small (~1.5 million) population.

In his book Untapped: The Scramble for Africa's Oil (pictured above), John Ghazvinian notes some of the attractions of West African crude: it's light and sweet (so it's cheaper to refine), and it tends to be easy to transport. The oil from Vaalco's wells off the coast of Gabon, for example, is pumped to Vaalco's FPSO (Floating Production, Storage and Offloading facility), and from there it can be taken by a tanker Northwest across the Atlantic to the U.S. No perilous journey through the Persian Gulf, or through a pipeline running through some former Soviet Republic. Another advantage, at least for the oil Vaalco is currently producing from Gabon, is low production costs. Costs averaged under $10 per barrel over the last quarter.

Vaalco has come down from its recent 52-week high of $8.99, as oil prices have declined, and at today's closing price of $5.69, it has a market cap of $336 million with about $100 million in net cash. Backing out that cash, it currently trades with an enterprise value about 7x its trailing twelve months earnings and about 6x an analyst's estimate of its '09 earnings. The company also has an exploration program expected to start this fall that could significantly increase its production and reserves.

The Credit Crisis a Year Later

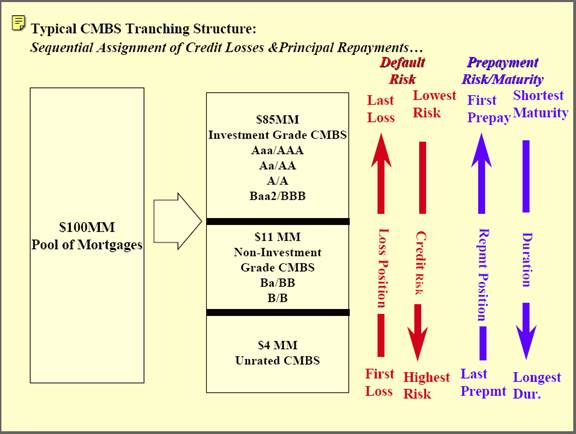

Articles with similar titles are sprouting up in the financial media now, so I thought it would be worth posting a link to John Mauldin's excellent essay on this from last August, "The Panic of 2007". Mauldin's essay includes helpful charts such as the one above and offers a lucid explanation of CDOs comprised of mortgage backed securities.

One suggestion Mauldin had back then for ameliorating the crisis was for Warren Buffett to take over Moody's, which he owns about 20% of through Berkshire Hathaway (as he took over Salomon Brothers years ago), to restore faith in the rating agencies. Of course, that didn't come to pass (instead, Buffett later created a muni bond insurer, Berkshire Hathaway Assurance, to profit from the crisis in which Moody's and the other rating agencies played a supporting role) but I wonder if it would have helped anyway. At Salomon Brothers, the problems were regulatory violations (of Treasury auction rules) that Buffett wasn't aware of (and of course wouldn't have condoned) at the time they were committed; at Moody's the problem was the way it did business, awarding triple-A credit ratings to so many questionable mortgage backed CDOs. As an insider, one would think that Buffett would have been aware of this practice at the time, so he might not have had the same credibility coming in to clean the stables at Moody's that he had coming into Salomon.

Sunday, August 10, 2008

Recapping the Alloy Steel Situation

What Happened?

Alloy Steel's shares dropped sharply Thursday after the release of the company's 10QSB, which showed $2,541,776 in sales, and net income of $230,946 or $0.014 per share, versus $4,206,235 in sales, and net income of $1,154,206 or $0.068 per share for the previous quarter.

Why did the stock drop so much?

Mainly because the sequential drop in revenue was so steep, and that suggested to some investors that demand for the company's patented Arcoplate alloy steel wear plates had weakened.

Demand didn't weaken? That was a big sequential drop in sales.

Sales were certainly down sequentially, but part of this appears to have been a timing issue. Since the company has profit margins of about 50%, and it showed $785,000 in finished goods on its balance sheet for the quarter, the $785,000 in finished goods listed on the balance sheet represents about double that amount in sales. So had those sales hit in the June quarter, that would have added about $1.57 million to the top line.

So the shares dropped because of that?

They probably would have gone down even if those sales had hit during the quarter, since even with that ~$1.57 million in sales there would have been a sequential decline, but the decline wouldn't have been as steep (e.g., from $4.2 million to $4 million, instead of from $4.2 million to $2.5 million), so the stock probably wouldn't have gone down as much.

Is the investment thesis still intact?

I think so. In addition to the finished goods which represent pending sales, last month the company released an 8-K announcing a $1.8 million order from Fortesque Metals Group in Australia and a $630k order from a client in Malaysia. A month earlier, the company announced that it was in the last stages of negotiating a joint venture with a Mongolian conglomerate (although this probably won't contribute to revenues until sometime next year).

More generally, the company's product has been accepted by the major mining companies operating in Australia, and if it makes sense to use Arcoplate wear plates on mining equipment in Australia, because Arcoplate reduces downtime and increases the efficiency of mining operations, then it makes sense to use it on mining equipment in Brazil, Canada, the U.S., etc., so there is a significant potential international market for the product.

What is the investment thesis again?

Alloy Steel is a 'picks & shovels' play on the mining industry. Its patented alloy steel wear plates reduce wear, which prolongs the life and reduces the downtime of mining equipment. These wear plates reduce "hang up" and "carry back" -- the tendency of ore and other materials to adhere to the surfaces of truck beds, bulldozer shovels, etc. "Hang up" and "carry back" reduce the efficiency of mining operations, because they reduce the volume of ore being produced per truckload, scoop, etc. Arcoplate also has applications in infrastructure, as these wear plates can perform the same function on earth moving and excavation equipment. The company has also developed a computerized process to apply a layer of alloy steel inside pipes, but has put this application on hold due to demand for the Arcoplate wear plates.

How do you know investors won't be disappointed by next quarter's earnings?

I don't, which is part of what makes this interesting. But I am still confident in the Alloy Steel's longer term growth prospects, so I remain bullish on the company.

Update: Due to the price drop last week, which lowered Alloy Steel's enterprise value as relative to its trailing twelve month earnings, the company is now on the Magic Formula top-100 list. I don't expect this will expose the company to a lot of new investors though. Given its performance since the publication of the book, the Magic Formula probably has fewer adherents today, and my sense (from reading Yahoo's Magic Formula message board) is that most of those who still follow it strictly stick with stocks with a minimum market cap of $100 million (Alloy Steel's market cap is about $30 million).

Saturday, August 9, 2008

A Tall, Cool Drink of... Sewage?

Tomorrow's NY Times Magazine has a general interest article by Elizabeth Royte on the processing of sewage into drinking water, "A Tall, Cool Drink of... Sewage?". The article notes that the reprocessed water is purer (as measured by "T.D.S.", "total dissolved solids") than reservoir water (or even bottled spring water), and yet then Orange County, California treatment plant she profiles pumps the treated water into a reservoir where it filters through sand and gravel for a few months before being pumped into taps by utilities:

In other words, nature messes up the expensively reclaimed water. So why stick it back into the ground? “We do it for psychological reasons,” says Adam Hutchinson, director of recharge operations for the water district. “In the future, people will laugh at us for putting it back in, instead of just drinking it.”

Some have said that the scarcity of potable water in many parts of the world represents a macro trend from which investors can profit, perhaps by investing in the companies that build wastewater treatment plants, or some of the equipment those plants use. I haven't done much homework in this, but I plan to look into it at some point.

Update: Today's NY Times Business Section includes a related article, The Feed: "Can Israel Find the Water it Needs?". The article mentions an Israeli multinational, Netafim, that's active in drip irrigation as well as wastewater treatment and other water resources areas, but it isn't publicly traded.

Also, reader SL directed my attention to this article in the current Barron's, about American Water Works (NYSE: AWK), "The Spigot Reopens at American Water Works".

Friday, August 8, 2008

U.S. Energy Corp. Reports

Additional Answers from Alloy Steel's CFO

1) Why was the inventory (particularly the finished goods) number so high? Does this represent a pending shipment that should show up as revenue in the next quarter?

2) Did the natural gas shortage caused by the Varanus Island explosion reduce customer orders or affect deliveries in deliveries in the June quarter?

3) Did the construction of the new mill affect quarterly revenues? E.g., were workers pulled off of production to help with the construction of the new mill?

4) Are there any other specific factors which contributed to the 40% sequential decline in revenues from the March quarter to the June quarter, or is this just a result of 'lumpiness' of revenue?

5) Do you expect that higher revenue quarters will have higher margins, as a result of better allocation of fixed costs?

6) Did you hire a salesman this past quarter (I noticed you were recruiting one in Western Canada)? Was that part of the increased sales and administrative labor costs you cited as a factor in the higher SG&A?

7) Are you considering any measures to increase communications with shareholders? I know you mentioned during our previous correspondence that you were working to complete the investor section of Alloy Steel's website, but are you considering holding quarterly conference calls or issuing periodic press releases?

Here are his responses:

In response to your questions today:-

1. Inventory was built up in anticipation of a large order which has been received and revenue will emerge in the September quarter.

2/3/4. The gas problems had a small effect on orders but more particularly clients were looking at their own budgets and holding off ordering until after June 30. June 30 is the financial year end in Australia.

These factors plus in this industry there are other variables like the timing of plant shutdowns for repairs and the construction of new plant which we cannot predict; will cause fluctuations in quarterly revenue.

5. While overhead is better absorbed in high revenue quarters, it maybe that some high revenue sales have a lower profit mark up which affects the bottom line

6. We are currently negotiating with parties with the view to employment as sales persons for mainland USA and Canada.

7. Website is still unfortunately still a ‘work in progress’; we are looking at a various IR firms to possibly use for communications. We have been and will increase frequency where there is something to communicate in lodging 8Ks.

This provides some helpful clarity, particular the answer to 1), which is encouraging. I may have a follow up question re 6). I'll post any follow up Q&A in the comment thread below.

Update: As mentioned in the comment thread, since the company valued inventory in the 10Q by cost (using the GAAP standard of lower of cost or market value), the "finished goods" number mentioned in the 10Q, $785,430, actually represents about twice that amount of deferred sales, since the company has profit margins of about 50%.

Thursday, August 7, 2008

Further Questions for Alloy Steel's CFO

Alloy Steel's CFO, Alan Winduss, was kind enough to respond to some questions I posed to him last month (See: "Answers from Alloy Steel's CFO"). Today I sent him an e-mail with the following questions about today's 10Q. If he is nice enough to respond again this time, I'll post his answers on this blog.

1) Why was the inventory (particularly the finished goods) number so high? Does this represent a pending shipment that should show up as revenue in the next quarter?

2) Did the natural gas shortage caused by the Varanus Island explosion reduce customer orders or affect deliveries in deliveries in the June quarter?

3) Did the construction of the new mill affect quarterly revenues? E.g., were workers pulled off of production to help with the construction of the new mill?

4) Are there any other specific factors which contributed to the 40% sequential decline in revenues from the March quarter to the June quarter, or is this just a result of 'lumpiness' of revenue?

5) Do you expect that higher revenue quarters will have higher margins, as a result of better allocation of fixed costs?

6) Did you hire a salesman this past quarter (I noticed you were recruiting one in Western Canada)? Was that part of the increased sales and administrative labor costs you cited as a factor in the higher SG&A?

7) Are you considering any measures to increase communications with shareholders? I know you mentioned during our previous correspondence that you were working to complete the investor section of Alloy Steel's website, but are you considering holding quarterly conference calls or issuing periodic press releases?

Alloy Steel International Reports

Wednesday, August 6, 2008

When Stocks Decline After You Buy Them

Sometimes when stocks drop after you've bought them it's because you've made a mistake: you bought stock in a troubled company (e.g., OPMR), or you bought stock in a good company at the wrong time after ignoring the relevant macro trend (e.g., BBSI), or you bought stock in a good company but at the wrong price (e.g., at a too-high multiple).

Stocks can also decline after you buy them even if you've made none of those mistakes. A recent example for me is Exxon Mobil (NYSE: XOM). When I bought Exxon, it was benefiting from the relevant macro trend (the secular bull market in energy), and it was trading at an enterprise value/forward earnings multiple of about 9x. I tend to view an EV/forward earnings multiple in the single digits as a conservative price for stock, considering that market average P/Es declined to 10 at the end of the last secular range-bound market in stocks (see graph above, via Vitaliy Katsenelson; for more info on his thesis, see this post, A Secular Range-Bound Market? Vitaliy Katsenelson's Thesis). I purchased XOM at $86.69, and today it is trading at $78.33, partly due to the recent correction in oil prices, which has put downward pressure on a lot of oil stocks (e.g., the oil royalty trust I mentioned that had hit a 52-week high of $107 per share in June, BP Prudhoe Bay, closed at $81.89 today. Fortunately, my average cost on this one is under $60 per share).

It's never fun to watch stocks drop after you buy them, but when those stocks belong to well-run, profitable companies such as Exxon1, that have good prospects, are trading at cheap valuations, and have virtually bulletproof balance sheets, I'm not fazed. I'm content to hold these sorts of stocks, and in some cases would consider adding to them. I'm a little less sanguine when more speculative stocks I own decline.

1Note that Exxon's mega cap size isn't what gives me confidence in the company. I have similar confidence in other, much smaller, companies thats stocks have declined since I bought them, e.g., Hudbay Minerals (TSX: HBM.TO), and Heidrick & Struggles2 (Nasdaq: HSII) that are also profitable, trade at cheap valuations, have virtually bulletproof balance sheets, etc.

2Heidrick & Struggles, incidentally, reported a solid second quarter today, beating consensus earnings estimates by 6 cents.

Tuesday, August 5, 2008

Interesting Times at Optimal Group

Optimal Group (Nasdaq: OPMR) is one of five stocks I bought last August in my fourth Magic Formula tranche. All except one, Vaalco Energy (NYSE: EGY), are down significantly since then. Since most of the conceivable bad news has been priced into the four stocks that are down, I've been waiting for their earnings to be released to sell them, on the off chance that some good news might move the stocks up a bit. Optimal Group released its earnings today, but, at the last minute, postponed its conference call to 9am tomorrow due to "pending news". Optimal Group was primarily an electronic payment processor that ran into trouble with (and had some assets seized by) the Department of Justice relating to internet gaming. Subsequently, it diversified into something completely different by buying a toy company called WowWee, which sells, among other things, a creepily realistic, animatronic talking Elvis bust (pictured above, but you need to click on that last link and watch the video to get the full effect).

Last August 13th, when Optimal Group was trading at $5.94 per share, a writer named Ross Greenspan wrote an astutely bearish article about the company on Seeking Alpha, "Optimal Group: A Home-Run Value Trap". Greenspan wrote,

Based on cash per share and book value, Optimal seems like the most home run value stock in the market. But management is going to have to grow the business before anyone really starts to take notice. Otherwise, you're investing on the hope of a reversal of the gambling ban in the US.

[snip]

This stock is a value trap in plain sight, with no near-term catalysts to reverse this slide. The selling today is overdone, but with no upside catalyst, a bounce is all you can hope for.

Nine days later, Greenspan added a surprising addendum, in the form of a comment on his article,

Since the tone of my article was negative, I feel its important to disclose that I bought 50 Optimal Group today (8/22).

Optimal Group closed at $5.64 on August 22nd, 2007 (I unfortunately bought this at over $6 per share). Today it closed at $2.10.

It will be interesting to see what news tomorrow brings on this one, and I'm looking forward to unloading it in any case. A few expensive lessons from this:

1) Sometimes stocks trade at a discount to book value for a reason.

2) Buying stocks from the Magic Formula list without applying some common sense and doing sufficient due diligence on them is a mistake.

3) Diversification provides little protection when you are diversifying among a basket of poorly-selected stocks.

Monday, August 4, 2008

Aaron Edelheit on Hemisphere GPS's Q2

q2 was a good quarter, that was slightly disappointing on earnings, but nothing earth shattering. Again, I think investors are starting to miss out on how good the next year could be.

Consider the following:

1) I believe that the company will sign a big contract with Agco by year end. This will cause sales to really jump next year.

2) The company is making in-roads into Russia/East Europe. That should show up next year

3)The company has a slew of new products coming out in q4, including a drive by wire autosteer product that has no competitive alternative.

4)The company has started working with their products for sugar cane harvesting. Penetration for GPS is negligible.

Those are just some of the reasons 2009 should be a blow out year. With the performance of this company and the management, and the competitive position they are in, who cares about any one quarter? They continue to move in the right direction and I think one day they will be bought out.

I continue to think this is a $6-$8 at the end of next year barring a major NA drought.

Although we've learned that Edelheit doesn't respond to questions about his stocks on his blog, it's good to know he still responds to questions on the VIC.

Edelheit originally recommended Hemisphere in July of 2006 when it was called CSI Wireless and was trading at C$1.50 per share. HEM.TO closed today at C$3.81 per share.

KSW Reports

Financial Highlights for the quarter ended June 30, 2008 include:

Financial Highlights for the quarter ended June 30, 2008 include:

* Total revenue increased 13.9% in second quarter 2008 to $22 million as compared to $19.3 million in second quarter 2007;

* Net income in second quarter 2008 was $1.1 million, or $0.17 per basic and fully diluted shares, up from $860,000, or $0.14 per basic and fully diluted shares in the same period of the prior year;

* Backlog set a record at $139.1 million as of June 30, 2008;

* As of June 30, 2008, cash, cash equivalents and marketable equity securities totaled $17.9 million;

* On April 30, 2008, the Company’s Board of Directors declared a cash dividend of 20 cents per share. The aggregate amount of the dividend was $1.26 million, and was paid on June 17, 2008 to shareholders of record as of May 26, 2008.

Financial Highlights for the six months ended June 30, 2008 include:

* Total revenues increased by $5.2 million, or 13.9%, to $42.5 million, as compared to $37.3 million for the six months ended June 30, 2007;

* Net income rose to $1.9 million, or $0.31 per share-basic and $0.30 per share-diluted, as compared to net income of $1.76 million, or $0.29 per share-basic and $0.28 per share-diluted for the six months ended June 30, 2007;

* Since January 1, 2008, KSW has been awarded $70 million in new contracts.

KSW is one of the companies I had in mind when I wrote this recent post, "Why Worry About Small, Thinly-Traded Stocks?", particularly the part where I questioned the conventional wisdom about risk (i.e., large is less risky than small, etc.). KSW may be a micro cap, but it seems to have a lot less risk than many much larger companies. This is a $31 million market cap company with no debt and nearly $18 million in cash, and a backlog of business about 1.75x its revenue over the last twelve months. As with many companies, KSW's business can be vulnerable to weakness in the overall economy, but the size of its backlog -- and the amount it increased by in the first half of this year -- are encouraging. Other risks plaguing many larger companies don't affect KSW directly. Since it isn't a consumer business, the weakness of the U.S. consumer doesn't affect it directly; since it is self-financing (KSW's general counsel mentioned to me on Friday that the company has never borrowed money), it isn't affected directly by the credit crisis2, etc.

After cash and stock dividends over the last year and a half, my average cost on KSW is about $5.80 per share, so I'm down on this one, but I am content to hold it.

1KSW recently switched its listing to the Nasdaq from the American Stock Exchange, and was allowed to keep its three-letter symbol.

2Of course, the credit crunch can of course affect KSW indirectly, if a lack of financing prevents its clients from initiating construction projects. So far, thankfully, that hasn't been the case.

Sunday, August 3, 2008

Update on Varanus Island

In a previous post ("Answers from Alloy Steel's CFO") among the questions answered by Alan Winduss, the CFO of Alloy Steel International (OTCBB: AYSI.OB) was this one,

Have you been materially affected, or do you anticipate being materially affected by the reduced natural gas supply as a result of the Varanus Island explosion earlier this month?

The Varanus Island plant provided 30% of Western Australia's natural gas, and the supply disruption resulting from the explosion has, according to Perth Now caused some mining companies (Alloy Steel's clients) to suspend some operations or resort to more expensive diesel to run their generators.

This was Mr. Winduss's response,

We expect to experience a slow down in orders from some mining companies effected by the gas shortage; however the timing of this cannot be determined.

Perth Now reported some positive news on this Friday ("Gas supply repairs ahead of schedule"):

US-based Apache Energy said today that output of 110 terajoules a day would resume next week, slightly ahead of schedule, following the June 3 explosion.

Full production is not expected to be restored until the end of the year.

On June 23, Apache said it hoped to bring on partial production of 200 terajoules by August 15 and full production of 350 terajoules by December.

It said the schedule was now 240 terajoules a day within a few weeks and full production by the end of the year.

[snip]

WA Premier Alan Carpenter welcomed the news the Varanus plant would be back in operation ahead of schedule, but said it did not mean the situation was resolved.

``Having 80 terajoules in that pipeline by Tuesday next week and 110 by the end of the week ... means of course that a very much improved situation is sitting out there in front of us,'' he said.

Saturday, August 2, 2008

ExxonMobil and Taxes

Exxon already faces a stiff tax bill -- nearly 50% of its taxable income went to the government in the most recent quarter.

The specific effective income tax rate ExxonMobil paid for Q2 was 49%, according to p. 5 of the company's earnings press release PDF. A commenter on Matthew Yglesias's post on this ("The Good Times Roll") on his Atlantic blog was skeptical that Exxon paid this much in taxes and asked how the math worked out. After looking at the company's income statement (on p.8 of that earnings press release), I was curious, so I called the company's investor relations department to find out. The I.R. representative didn't know the answer offhand, but called me back with the answer after an hour or so. Here's how the math works out:

The numbers below are in millions of dollars and come from p.8 of the company's press release PDF.The "income before income taxes" number [22,206], includes post-tax income from Exxon's equity companies, so you have to add the taxes those companies paid [888] to that number. You also have to add that 888 to the main income tax number, 10,526. So here's the arithmetic:

(10,526 + 888) / (22,206 + 888) = .494 or 49%.

Left unsaid by the Los Angeles Times editorial is that ExxonMobil pays other taxes in addition to income taxes. P.8 of the earnings press release notes that the company paid $32.36 billion in total taxes last quarter, including sales and other taxes.